Oil’s next surge to increase inflation angst

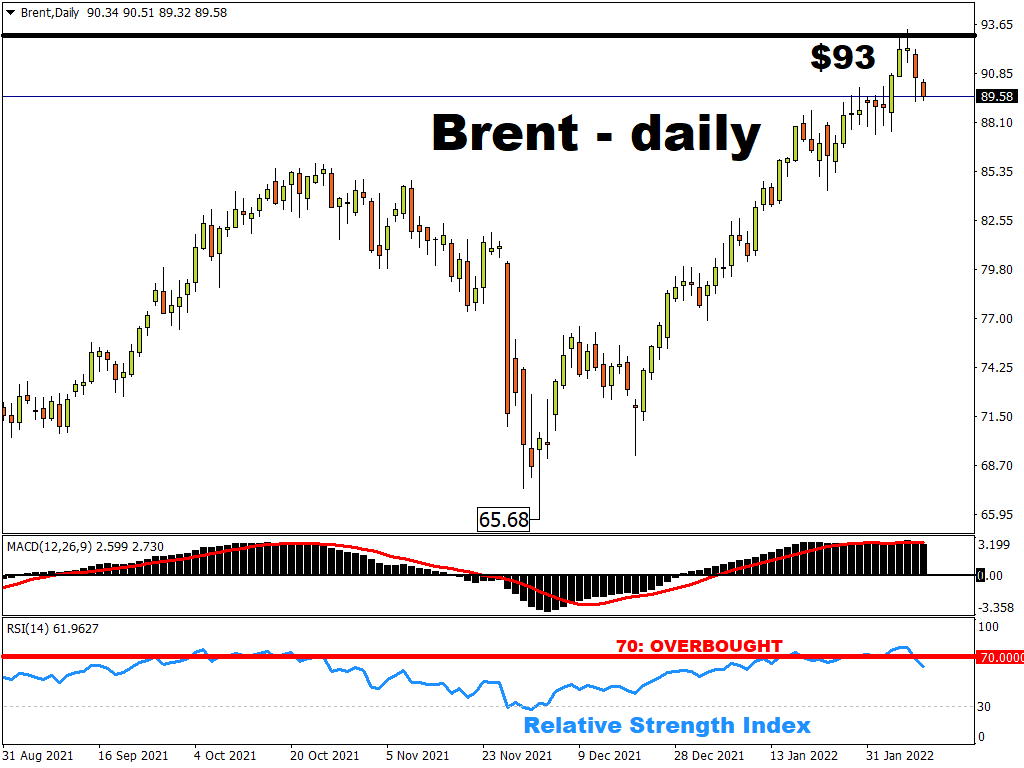

Oil prices are cooling further from recent multi-year highs following the EIA’s raised forecasts for US production this year and next, which they forecast should peak at a record 12.6 million barrels per day in 2023. Positive developments surrounding Iran nuclear talks are also helping to put the brakes on oil’s recent rally. Yet, Brent is keeping its head above $90/bbl for the time being, while US crude is trading just below that psychologically important mark.

Oil benchmarks still find themselves in a supportive environment, one that features robust global demand, falling inventories, and lingering supply constraints, while geopolitical risk premiums are being added to the commodity’s bullish drivers. Tuesday’s API figures, which pointed to a surprise drawdown of over two million barrels last week, helped limit the recent drop in prices.

Markets are expecting an overall build in today’s release of US crude inventories of 1.5 million barrels, though the whisper number suggests an increase of just 238,000. However, oil prices will likely be more sensitive to the figures for crude stockpiles in Cushing, which have fallen for four consecutive weeks. Overall, the official EIA data must uphold the notion of a tightening market which may then restore oil to the multi-year highs of late.

Higher-than-expected US CPI may spark more volatility

The rally in oil prices has provided major fodder for inflationary pressures, which in turn has forced central banks to adopt a more aggressive monetary policy stance. The Bank of England has already pulled the trigger on back-to-back rate hikes, while the European Central Bank and the Federal Reserve have recently made hawkish pivots, with a view to reining in liquidity and raising interest rates.

Thursday’s release of the January US CPI is set to grab the market spotlight this week. Headline inflation is expected to come in at 7.3% year-on-year, while the core print which strips out food and energy costs, is forecasted to come in at 5.9%. Both of these figures, if confirmed, would mark their highest readings since 1982, showcasing the beast that central bankers must tame.

Investors and traders have been trying to get used to the prospects of a steeper ramp-up in policy tightening this year, hence the wild swings in various asset classes along the way. Markets remain exposed to the shifting sands in the outlook for US monetary policy until they can get a firmer grasp on the Fed’s path forward for the reduction in its balance sheet and interest rates hikes. Although positive surprises in the remaining US corporate earnings may offer some measure of relief over the immediate term, equity markets could still be roiled by the next major selloff in US Treasuries, with tech and growth stocks particularly at risk.