Risk appetite, ECB policy muddied by Ukraine crisis

Asian stocks are mixed while US and European futures are in the green, as markets are tossed about by the headline blitz stemming from the Ukraine crisis. Oil benchmarks have persisted with their parabolic climb, with Brent still trading around its highest levels since 2008 and making further headway towards the psychologically important $140 level.

The inability of stock markets to post a meaningful recovery shows that risk sentiment remains strangled by worries about the global fallout from the war. The US and UK’s decision to ban imports of Russian oil is set to fan the flames of global inflation, which in turn raises the spectre of demand destruction.

Sanctions aimed at isolating resource-rich Russia from the global economy is expected to hurt the rest of the world via inflation shocks. China’s higher-than-expected producer price index of 8.8% compared to the start of 2021 is just the latest symptom of the red-hot inflation that already besets the global economy. Price pressures are likely to build up further as long as Russia’s commodity exports are disrupted, which would then exert even more pain on global demand.

ECB likely to stress caution amid Ukraine crisis fears

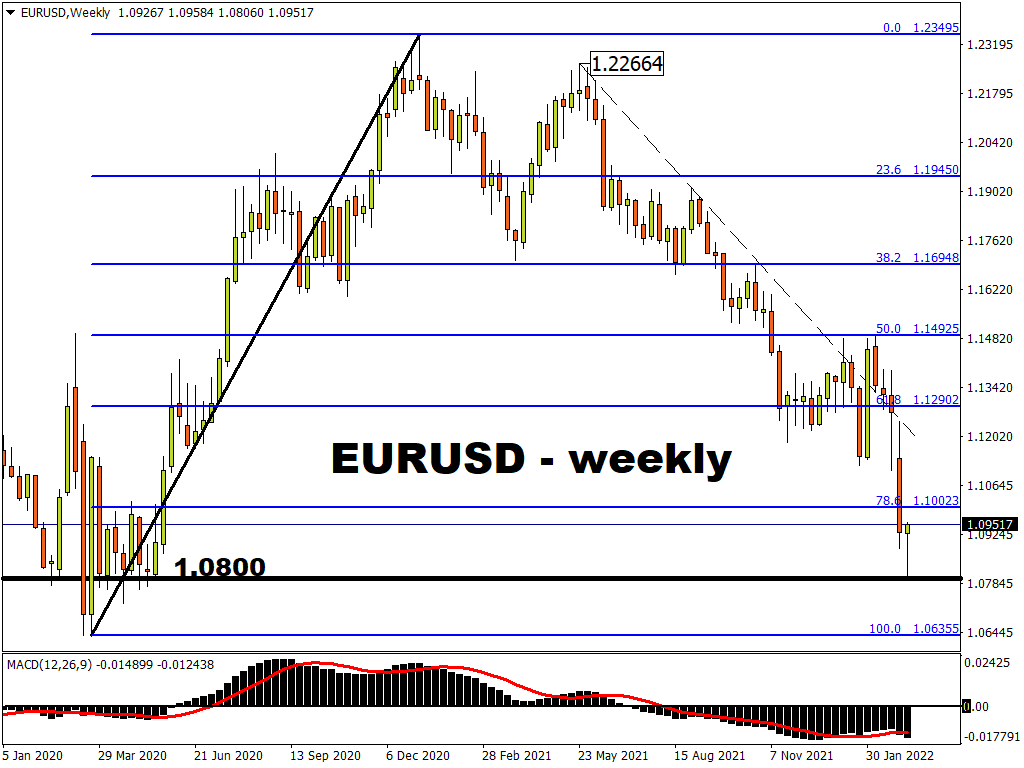

The raging uncertainties could also freeze the European Central Bank into inaction, unable to respond to surging inflation for fear of halting the region’s economic recovery. Global investors and traders will be closely monitoring how ECB President Christine Lagarde presents the balance of risks to the Eurozone’s economic outlook at her press conference at Thursday’s policy meeting. While a build-up in price pressures would typically spur policymakers into a more hawkish stance, such biases will be swiftly quelled by signs of worsening sentiment and economic activity on the continent.

The euro has seen a technical rebound, reclaiming the 1.09 handle versus the dollar, as the world’s most-traded currency pair attempts to pull away from oversold conditions. Further signs of policy divergence between the ECB and the Fed would likely heap more downward pressure on the single currency, potentially setting EURUSD on a path towards 1.06, a level not seen since the onset of the pandemic.

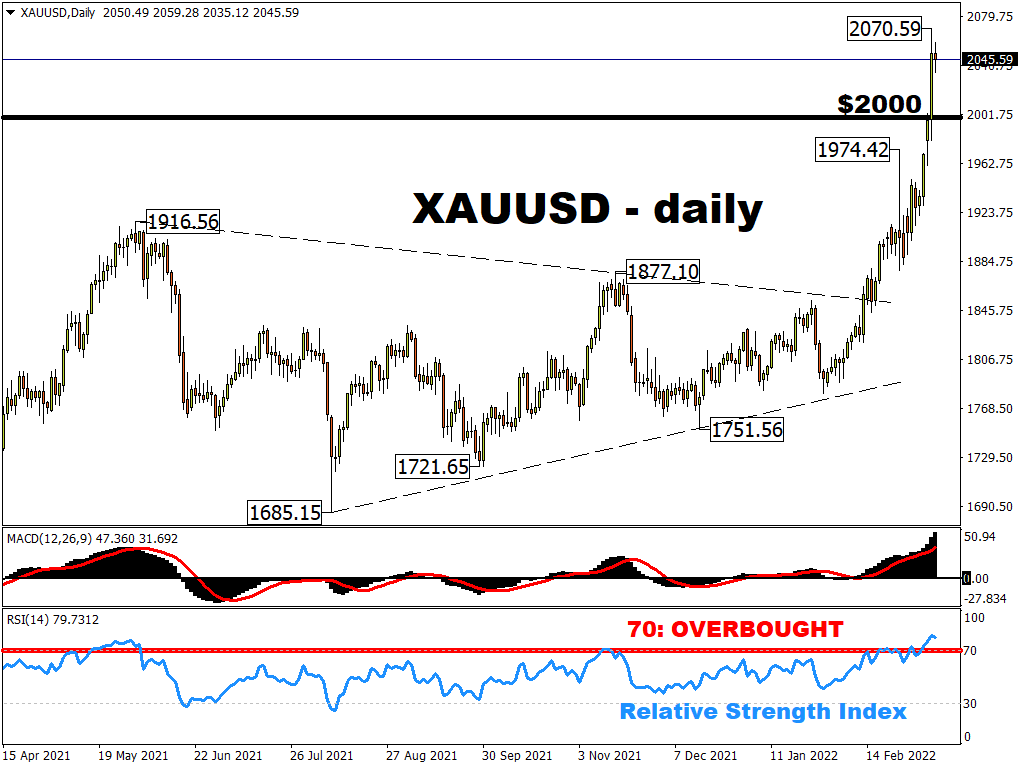

Russia-Ukraine war puts bullion within reach of new record high

At the time of writing, spot gold is hovering just below its all-time peak of $2075.47 registered back in August 2020. The precious metal promises more near-term gains on further escalation in geopolitical tensions that darkens the global economic outlook.

Although inflation shocks may amplify the hawkishness of other major central banks, it should also bolster gold’s traditional role as an inflation hedge, especially amid fears of stagflation. If markets perceive a greater risk of a global recession, perhaps triggered by a policy error from a major central bank, that could translate into further demand for safe haven assets. Such a fear-filled narrative is set to pave the way for gold bugs who already appear hell-bent on a fresh record high.