CAD fights back as oil rallies

Improved risk appetite has seen most commodities starting the week with decent gains, not least supported by a softer dollar. This has resulted in the pro-cyclical currencies like AUD, NZD and CAD rebounding strongly.

Brent crude settled close to 5.5% higher yesterday as it enjoyed its biggest one-day rally in five months. With taper doubts emerging around the Jackson Hole event later in the week, risky assets are enjoying a welcome relief rally after oil suffered its worst week since last October. Prospects for improved demand had been crimped by Chinese growth worries and the Delta variant.

Strong rebound in black gold

There are now more encouraging reports of no Covid cases in China for the first time since July. If the latest outbreak is behind us there, worries about oil demand may now start to ease. Some US Covid hotspots like Florida are also showing clear signs that this wave is cresting and could be the final big one to hit the US.

The commodity and oil bounce has been helped by the increasing doubts as to whether the Fed Chair Powell may delay a strong taper signal to markets on Friday. This has caused broad dollar weakness which in turn has seen USD/CAD drop more than two big figures from last week’s peak.

Loonie dependent on risk tone

CAD is being driven by external drivers at the moment. That means the broader USD outlook is key along with the overall risk environment. That said, if this continues to improve in the short-term, the hawkish Bank of Canada offers significant support with another tapering of asset purchases at its October meeting expected by many market watchers.

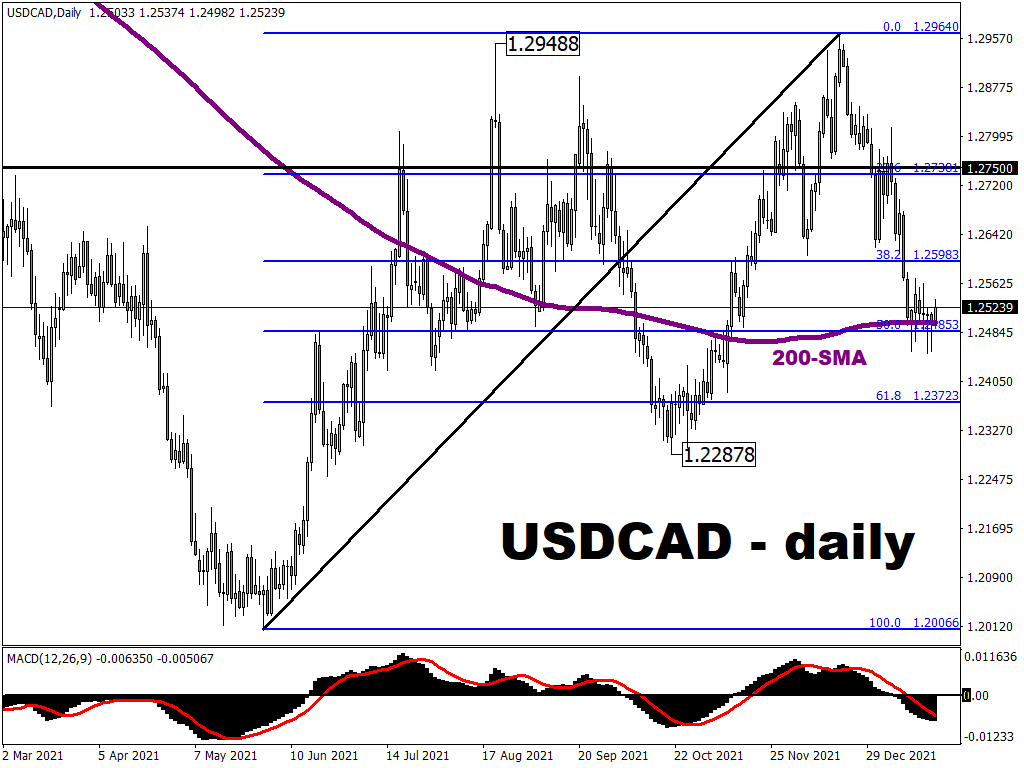

Bearish technicals hit USD/CAD

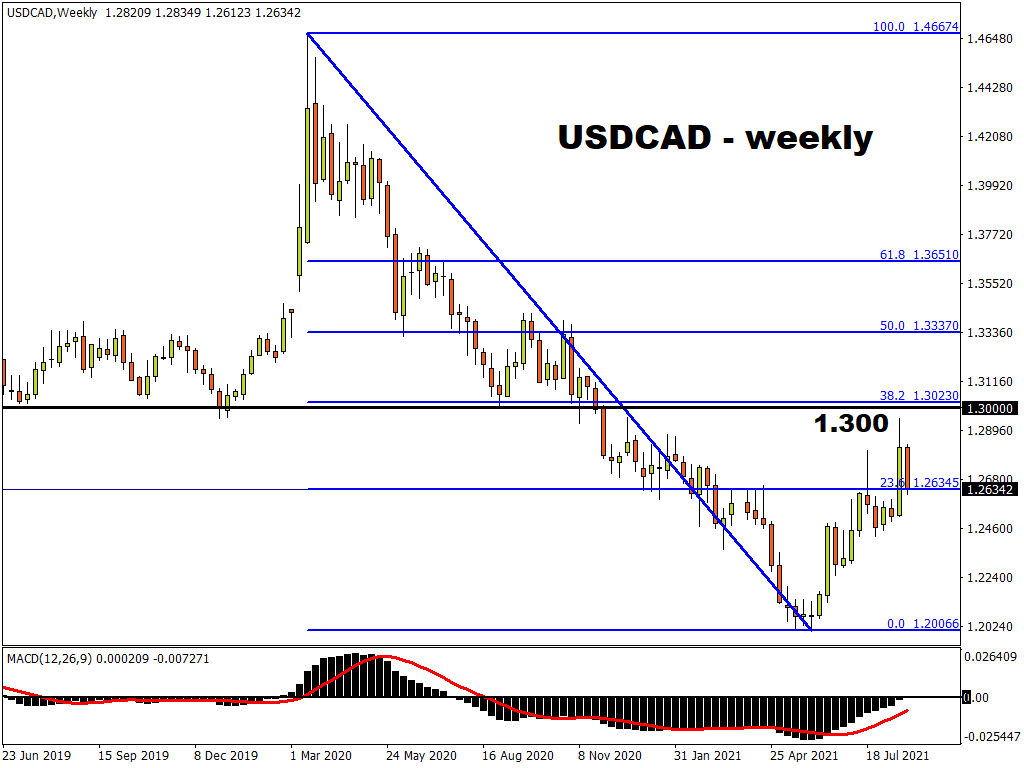

USD/CAD had veered into overbought territory last week with several triggers for an imminent correction in the pair. The 1.30 level was a major resistance zone as it marked the bottom through 2019 and the latter part of 2020. An important Fib retracement level (38.2%) of the March 2020 to June 2021 decline also resided just above here at 1.3023.

Last Friday saw sellers gain the upper hand with a bearish pin bar candle firmly rejecting higher levels. Yesterday’s price action then saw USD/CAD print the final leg of a bearish “evening star” candlestick pattern. This three-candle reversal pattern usually occurs at the top of an uptrend and signals the slowing down of upward momentum before a bearish move lays the foundation for a new downtrend.

The low close yesterday has confirmed the pattern and the retracement is expected to fall towards 1.25. Near-term support comes in at the 200-day moving average around 1.2550, with the August support below here at 1.2490.