Gold Retreats Ahead of Jackson Hole

The next two days could be choppy for gold prices as investors brace for the biggest market-moving event of the week.

All eyes will be on the Jackson Hole Economic Symposium on Friday where Fed Chair Jerome Powell is scheduled to deliver his highly anticipated speech virtually. Given the mounting anticipation and build-up to this key risk event, there could be fireworks regardless of the outcome.

Although markets expect Powell to clarify the central bank’s position on tapering, expectations could differ from reality.

It’s worth keeping in mind that Powell has maintained a stubbornly dovish stance despite the economic recovery in the United States and inflation remaining at a 13 year high. If he strikes a cautious tone and fails to provide the tapering roadmap, this may prompt traders to push back their expectations for tapering and any potential interest rates hikes. Such an outcome is seen weakening the dollar and injecting renewed life back into zero-yielding gold.

Alternatively, a Powell that not only resonates with the hawks among Federal Reserve officials but drops a formal announcement on tapering could spark a rally in the dollar. Ultimately such an outcome will weigh heavily on gold prices as the commodity is pincered by a resurgent dollar and expectations of a Fed rate hike sooner than expected. Another key event that may influence gold will be the Fed’s preferred inflation gauge, the PCE price index. Currently, core PCE is at 3.5% and headline inflation as measured by CPI is at 5.4%. Should the report signal signs of rising inflationary pressures, this could fuel speculation over the Fed tapering sooner than expected.

When considering how gold remains sensitive to inflation data and Fed taper talk, the next few days promise to be eventful.

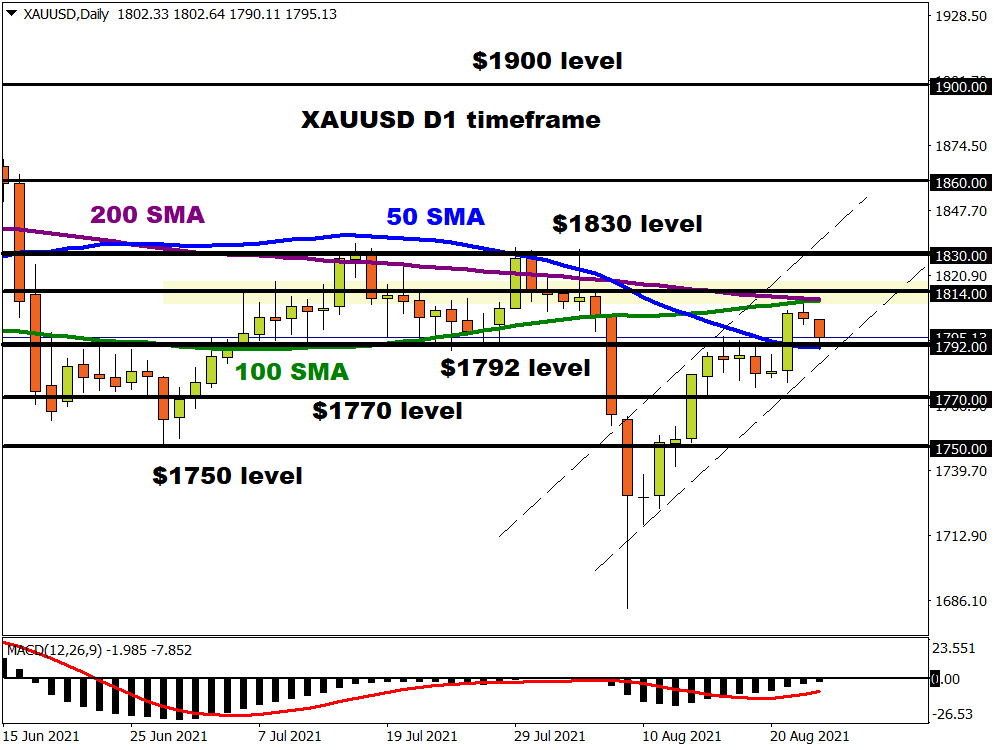

Looking at the technical picture, gold remains in an uptrend on the daily charts based on the consistently higher highs and higher lows. However, lagging indicators such as the Simple Moving Average and MACD suggest that bears still remain in the vicinity. There is some resistance around $1814 which is where the 100 and 200-day Simple Moving Averages reside. If $1792 proves to be unreliable support, a decline back towards $1770 and $1750 could be on the cards.

Alternatively, a solid breakout above $1814 could trigger an incline towards $1830. Now if bulls can clear $1830, the next key levels of interest can be found at $1860, $1877, and $1900.