JPY outperforms in risk aversion

Safe haven currencies are top of the pile this month and have appreciated again at the start of this week. The rapid spread of the Delta strain of Covid-19 has scared investors and put economies that had been steadily recovering on the back foot. Of course, investors have been pondering if we were now reaching “peak reopening” both in terms of economic data and in earnings.

Certainly, the strong bid in bond markets and with it, the corresponding collapse in yields does point to investor skittishness in the face of uncertainty over the path of Fed policy. Indeed, we saw only last week bumper US inflation figures leading to rising pessimism over the global growth story and a push back of the expected Fed tightening cycle.

We also probably won’t get much clarity on the next steps on the Fed’s path in the coming weeks until perhaps the Jackson Hole symposium in late August. In the meantime, summer markets mean less liquidity and risk taking and more volatility.

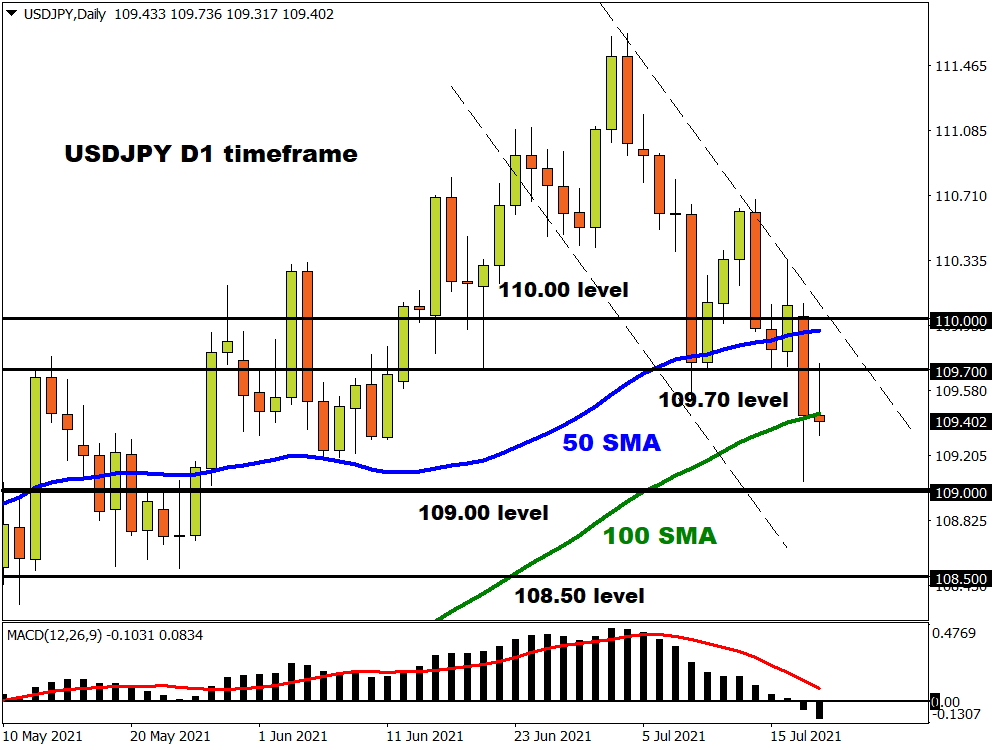

USD/JPY edging lower

JPY has been the week’s sole exception to dollar strength and has rediscovered its traditional safe-haven role. Real yield differentials point to further downside for USD/JPY which is correlated closely to US Treasury bond yields. The equity correction has only added to this and will push the pair lower if it continues. We note that corrections in the S&P 500 so far this year have been around 4-5% and the current one is around 3.6% so far.

Technically, the backdrop has deteriorated meaningfully with the pair creating new month-to-date lows yesterday and getting close to the 109 level. Prices are currently sat on the 100-day moving average with yen bulls looking to retest the 109.06 area as it is near a key Ichimoku support level and a Fibonacci retracement level of the late rally from the April lows. Beyond this, the late May support comes into play in a 108.50 zone. Only a dollar rally well clear of 110.00 would suggest that the downside threat is reversing.