New lockdown crushes kiwi and RBNZ rate hike hopes

A single new Covid-19 case in Auckland, New Zealand has forced the government to impose a new three-day national lockdown. This has slammed the kiwi, ahead of tomorrow’s RBNZ meeting, which was set to raise interest rates by 25bps, the first hike in seven years! The markets had also priced in another rate rise by the end of the year, with the central bank leading the way to policy normalisation.

Economy ticking along

Before today’s shock lockdown announcement, it was pretty clear that the RBNZ could start to remove last year’s emergency stimulus and return the policy dial back to a more normal one. Recently, we’ve seen a sharp drop in unemployment back to pre-Covid lows and a much better than expected move higher in inflation. Strong demand was also apparent with the housing market strengthening and inflation expectations the highest since 2014.

On the back of the improving economy, several local banks had been forecasting a cash rate at 1% by year end. This implied three rate hikes at today’s meeting, plus the October and November rendezvous. This aggressive outlook didn’t leave the NZD with much room to rise, with the bar set very high for a more hawkish surprise tomorrow.

Repricing of meeting and currency implications

Markets are now scrambling to adjust to today’s lockdown measures with NZD down over 1.5% and the AUD falling to nine-month lows. One of the major investment banks in the region now believes the RBNZ will leave policy on hold tomorrow in light of the new Covid-19 case.

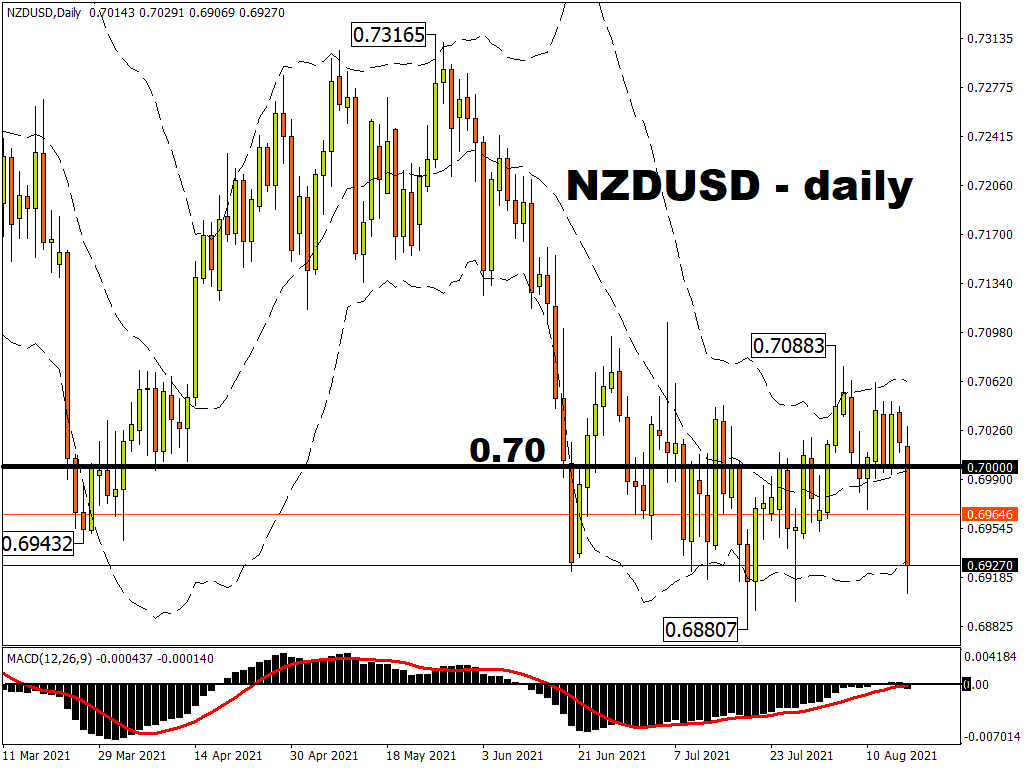

NZD/USD had been trading towards the top of the recent range above 0.70. Of course, the broader market mood had seen the dollar find a bid as well as growth expectations in the Asia-Pacific region were being rerated due to the Delta variant spread.

The major has now plunged today to the bottom of the recent range and is trading around previous pivot lows from March. More recent cycle lows sit just below 0.69 and are key support. Any signs of the RBNZ stepping back from their hawkish stance over the medium-term could push the kiwi further down through here towards fresh long-term lows. The flip side would see the bank maintain its hawkish tilt in some part, with prices rebounding off 0.69 once again.