Oil hits $76 as bulls take charge

It’s remarkable how the price of oil has almost doubled in value since the middle of June 2020.

Brent futures hit $76.00 a barrel on Wednesday, its highest level since October 2018 while WTI crude punched above $74.00. Both benchmarks have gained more than 3.0% this week thus far, with WTI up over 50% since the start of 2021.

Oil bulls remain in the driving seat amid expectations demand growth will outstrip supply. The reopening of economies has fuelled speculation over rising fuel demand while OPEC+ remain on a quest to rebalancing markets. With the fundamentals fuelling the bullish momentum, the key question is how much further can oil prices rise?

The rally continues to be powered by encouraging industry data that shows a consistent drawdown in U.S crude stockpiles. According to the Energy Information Administration (EIA), inventories in the US dropped by 7.6 million barrels for the week ending June 18. This was a larger draw than expected and came following a 7.4 million draw in the previous week. Such data is likely to reinforce expectations over robust fuel demand in the United States during the summer driving season. It does not end here.

Stalled nuclear talks between the US and Iran have cooled concerns over Iranian supplies returning to markets. With expectations fading over sanctions on Iran’s crude exports being removed anytime soon, oil bulls have one less thing to worry about.

On the supply side, OPEC+ will be under the spotlight next week as they discuss their output policy. A Bloomberg report said Russia is considering making a proposal to further boost production. Other OPEC+ nations were also discussing a potential supply increase in August. In the meantime, oil bulls remain in a position of power with the path of least resistance for both WTI and Brent pointing north.

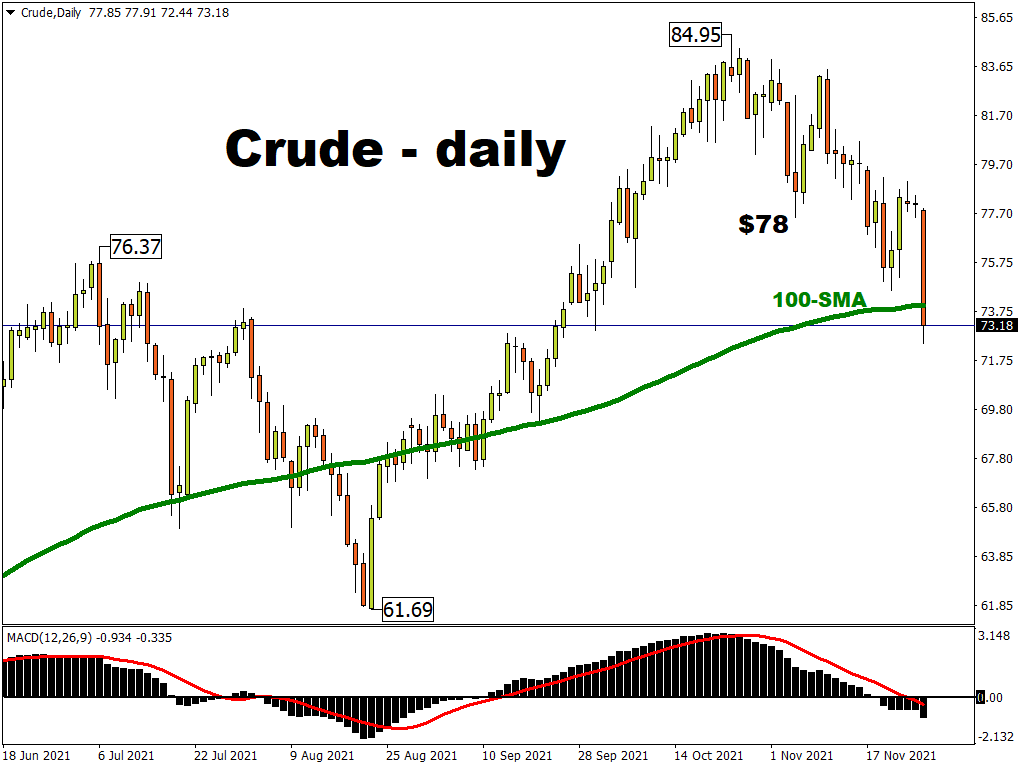

Taking a look at the technical picture, both benchmarks are heavily bullish on the daily charts. Brent could appreciate towards $77.90 and $80.00, respectively if a strong daily close above $75.00 is achieved. In regards to WTI crude, it has the potential to target $76.80 if bulls make easy work of the $74.00 level.