Oil market’s reaction to the Ukraine conflict

Energy markets continue to be well supported by geopolitics and the uncertainty of Russian supply. Brent crude prices rallied more than four per cent yesterday after tougher sanctions were revealed by the West, including plans to remove some Russian banks from SWIFT. With restrictions on the Russian central bank as well, the market has priced in some limited supply disruptions.

But it’s still unclear if Russian energy will be targeted so there is much uncertainty and volatility in the near term.

Oil prices gapped higher at the start of the week after the announcement of more Western sanctions against the Kremlin. While the energy sector has so far not been directly pursued, the ability for Russian companies to sell their oil has been sharply reduced on reports several international buyers have put Russia-related activities on hold for now. The actions of BP and Equinor that have pulled out of trade finance over the last 36 hours is indicative of current sentiment. This has seen Russian Urals oil trade at a record discount to dated Brent.

Russia, oil production and inflation

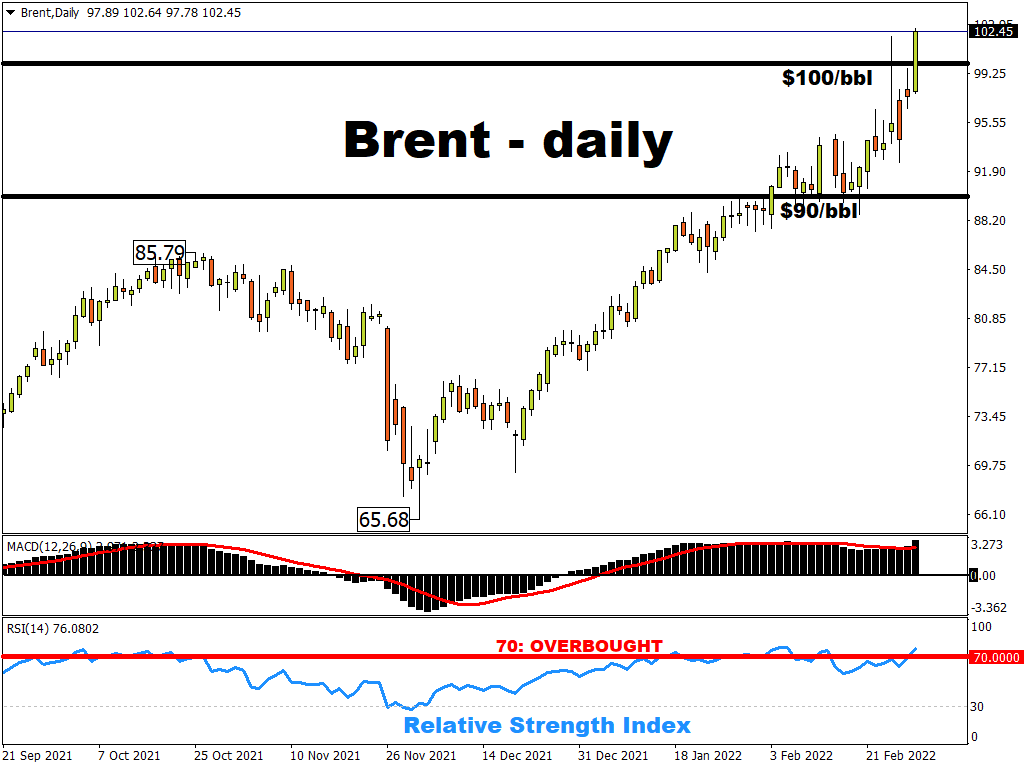

Russia’s offensive into Ukraine has repeatedly driven oil prices above $100 a barrel over the past week. Russian is one of the world’s largest energy producers, exporting about five million barrels a day and its output accounting for about 10 per cent of global oil production. It is also a major exporter of natural gas, accounting for more than a third of Europe’s supply.

The jump in energy prices is expected to impact further on rising price pressures and inflation across the globe.

Many analysts think the energy passthrough is going to be higher than it has been over the last few decades, which will increase the pressure on central banks to raise interest rates to combat higher inflation. CPI prints already touched multi-decade highs even before the Ukraine crisis. The key question here is whether this actually then crimps economic activity and slows the pace of growth we have been seeing in the pandemic recovery.

Possible relief to high prices?

There is now much speculation that the high oil price environment will lead to a coordinated stock release from the US and other countries. Indeed, the IEA is holding an emergency meeting today on a potential release which may offer some short-term relief to markets.

If there are more sanctions which mean major disruptions to Russian oil flows, the decision of OPEC+ will be a huge focus.

The cartel meets tomorrow where expectations remain that they increase their output by the already agreed amount of 400k in April. But restrictions targeting Russian supplies directly would push prices sharply higher and require more aggressive action from OPEC+. The fast tracking of the Iranian nuclear deal, which could add around 1.3 million barrels of supply to the market, would certainly help.

Upside price targets

Brent crude made a near eight-year high after the initial Russian incursion last week at $105.74. WTI breached the $100 psychological level at that time too.

Several investment banks have revised up their forecasts on fears of a forthcoming supply crunch, seeing $110 to $120 short-term price upside.

This is based on a few million barrels of demand destruction required to compensate for a one-month loss of Russian exports. The market is expected to be very well-supplied into the second half of 2022, which should blunt prices further out.