Stocks walloped by Fed tightening fears

Global stocks are taking a beating this week amid a surge in US Treasury yields as markets brace for the tightening of Fed policy. Asian stocks are taking their cues from Tuesday’s selloff on Wall Street, with US and European equity futures pointing to further declines at today’s open.

Markets are anxious over the Fed potentially taking a more aggressive approach to controlling inflation. Fed Funds futures have fully priced in a move in March, with a total of four rate hikes of 25-basis points each expected across the whole of this year. Some segments of the market are also fearing that the Fed might be forced to take a sledgehammer to suppress surging US inflation by triggering a larger 50-basis point hike in March.

Tech stocks bear the brunt of hawkish Fed

Such concerns have fueled the surge in Treasury yields while dragging tech and growth stocks lower, leaving the Nasdaq Composite index on the cusp of a technical correction. The tech-heavy index has also fallen below its 200-day moving average for the first time since the onset of the pandemic in March 2020. We note the Nasdaq’s 14-day relative strength index has dropped precariously and is close to the 30 threshold which denotes oversold conditions.

Tech aficionados will be hoping for a return of the “buy-the-dip” mantra that has helped the Nasdaq recover from oversold conditions in recent years, before going on to post fresh record highs. However, from a valuation perspective, another stunning comeback could be hard to justify over the near term. With an elevated current PE ratio of 37, there’s still room for valuations to fall closer in line to the long-term average of 25 seen over the last decade.

The upcoming tech sector earnings are also expected to underwhelm relative to the stellar figures reported in recent quarters. With Fed rate hikes looming on the horizon, there’s likely to be more legs to this tech rout, barring a positive surprise in their financial results.

Oil could take a step back before climbing higher

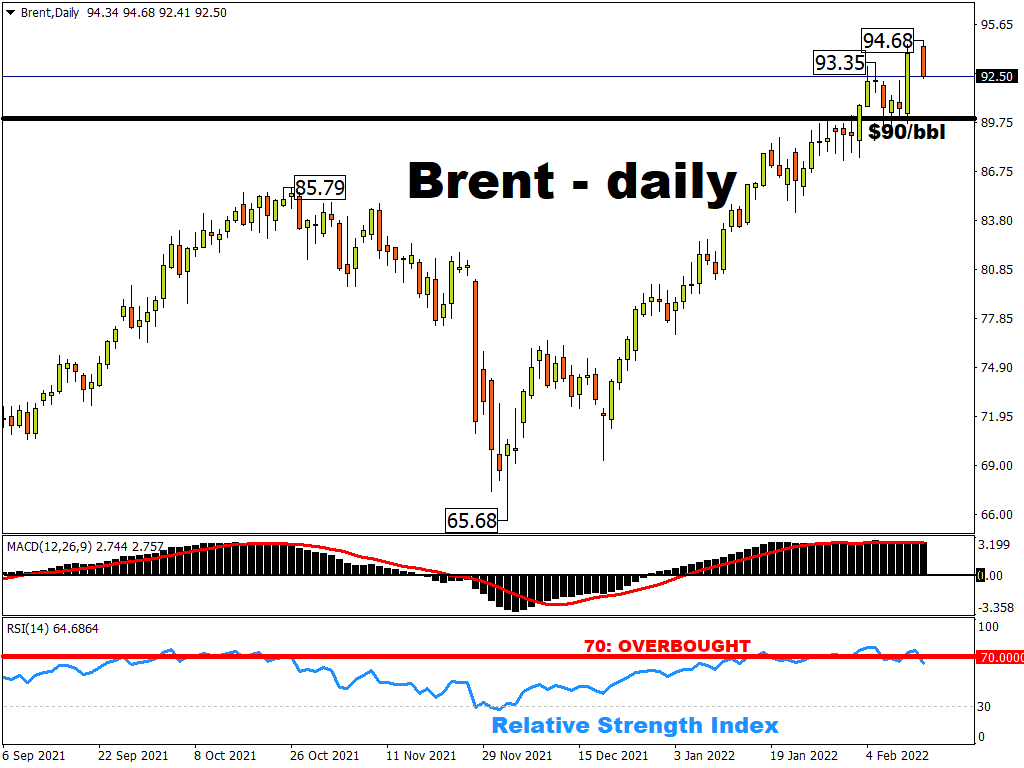

Surging oil prices are also stoking those inflation fears, with Brent futures already trading at their highest levels since 2014. However, an immediate pullback could be on the cards, with oil benchmarks now trading in overbought conditions on a technical basis. Any profit-taking is set to be limited, potentially pausing at the November peak around the mid-$80 region.

Overall, the fundamentals of oil markets still point to more gains. Expectations of a return to oversupplied conditions this quarter have been negated by supply disruptions, rising geopolitical tensions, and resilient global demand. Although the oil surge could invite more supply-side interventions by governments and suppliers, such measures aren’t expected to significantly dampen prices. $90 Brent is looking likely in the near future, amid a tightening market structure.