Super Week of Central bank Meetings

It’s a busy week for markets, one which will ebb and flow with numerous central bank meetings and the keynote US monthly jobs report released on Friday to round off the week. Prime focus for traders over the next few sessions will be the central bank meetings in the US and the UK.

“Substantial progress” moves the Fed’s policy dial

The FOMC is set to announce the start of tapering with mid-2022 seen as the likely optimal end date. The process should see bond and RMBS purchases reduced by a combined $15bn per month. A fairly confident message on inflation is expected, but with the labour market not yet fully recovered, more hawkish signals regarding rate hikes may have to wait. This should help support the dollar against those central banks and currencies still some way off policy normalisation, like EUR, CHF and JPY.

On the weekly chart, the widely watched Dollar Index (DXY) looks to have formed a double bottom reversal pattern around 90 during January and May earlier this year. Since then, prices have been edging higher, though five weeks of gains from September have come up against resistance more recently.

Last week’s bullish engulfing pattern looks positive for the greenback’s overall performance outlook. But there is a zone of resistance just above current prices starting around 94.43, with the October high at 94.56 and the March 2020 spike low at 94.65. The 200-week moving average sits at the top of this area at 94.79. Initial support around 93.27/50 needs watching if the Fed or the jobs numbers disappoint again.

Analysts split on BoE move

Will the Bank of England raise the Bank Rate or not? What was pretty much unthinkable at the start of the year is now a real possibility with markets fully pricing in a 15bp rate hike. That said, economists are evenly divided between a move and unchanged, with some believing that more data may be needed on the post-furlough economy. We also get the bank’s latest economic forecasts which may imply some pushback on the market’s aggressive pricing of more hikes next year.

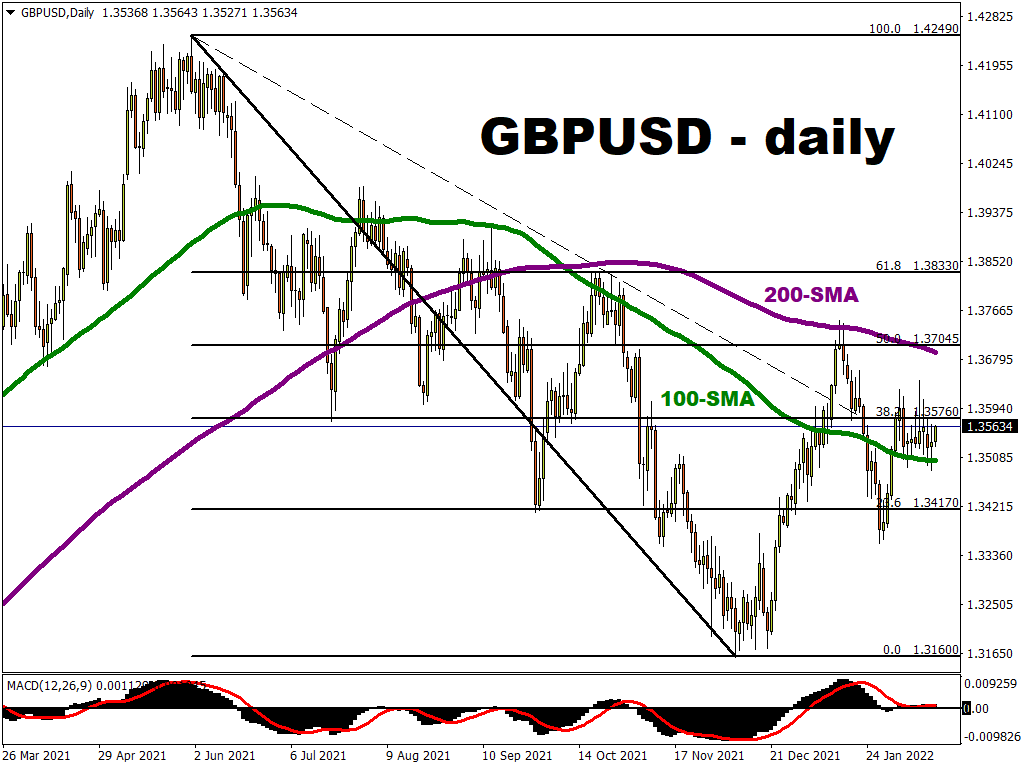

Cable’s continued failure to close decisively above 1.38 ended its rally since late September. Trendline resistance from the June high has also capped more upside above the October high at 1.3834. Friday’s weak close below 1.37 and the 50-day simple moving average at 1.3712 has signalled more losses this week. Next support lies at the August low at 1.3602 ahead of the July low at 1.3571. Upward momentum looks rather limited at present with the daily RSI pointing down and the MACD now in the red.