Stock of the week: What to trade when the market is at a record high

US stock markets rallied some 2% last week, the strongest performance since June. This pushed the S&P 500 to a fresh record high, which is one of the record highs set by the US blue chip index on 60 trading days so far this year. US stock markets have been buoyed by news that the US infrastructure spending bill has passed the House of Representatives, the US economy created more than 500,000 jobs last month across a broad range of sectors, and a successful trial of Pfizer’s new anti-viral pill that could defeat Covid also helped to boost sentiment. With the US economy re-accelerating, a strong Q3 corporate earnings season, the prospect of a Covid-free future, a patient Federal Reserve, a decent rise in auto sales, and unprecedented growth in the service sector no wonder stock indices are reaching record highs.

The tricky part for traders is, how do you trade when stock markets are at record highs. Concerns about the market eventually selling off and buying at the peak, something that traders want to avoid, will be top of traders’ minds right now. Below are three trade ideas that may withstand the pressure of record high stocks markets.

-

Goldman Sachs: We continue to like GS, not least because it continues to have one of the world’s most impressive M&A teams. The world is awash with cash right now, and deal-making is expected to rise to a record high above $5 trillion, after reaching $4trillion in the third quarter. This should boost Goldman Sach’s coffers for the coming quarters. Added to this, the Federal Reserve said last week that it would start tapering its Covid-era support, and it would end all stimulus in the second half of 2022. Fed Chair Jay Powell, said that the bank would pursue a patient approach when it came to interest rate increases, which can be bad news for banks. However, GS is less reliant on loan income compared with some of its more retail-focussed peers, thus it is less impacted by the Fed’s reluctance to raise interest rates, in our view. From a fundamental perspective, earnings growth is impressive so far in 2021, added to this the price performance has been exceptional, EPS has jumped more than 200% on average in the past three quarters. Also, GS’s stock price is up 55% so far this year. From a technical perspective, GS is tracking the S&P 500 closely, thus if you remain bullish for the overall market performance, then we would expect GS to continue to move in the same direction as the overall market.

-

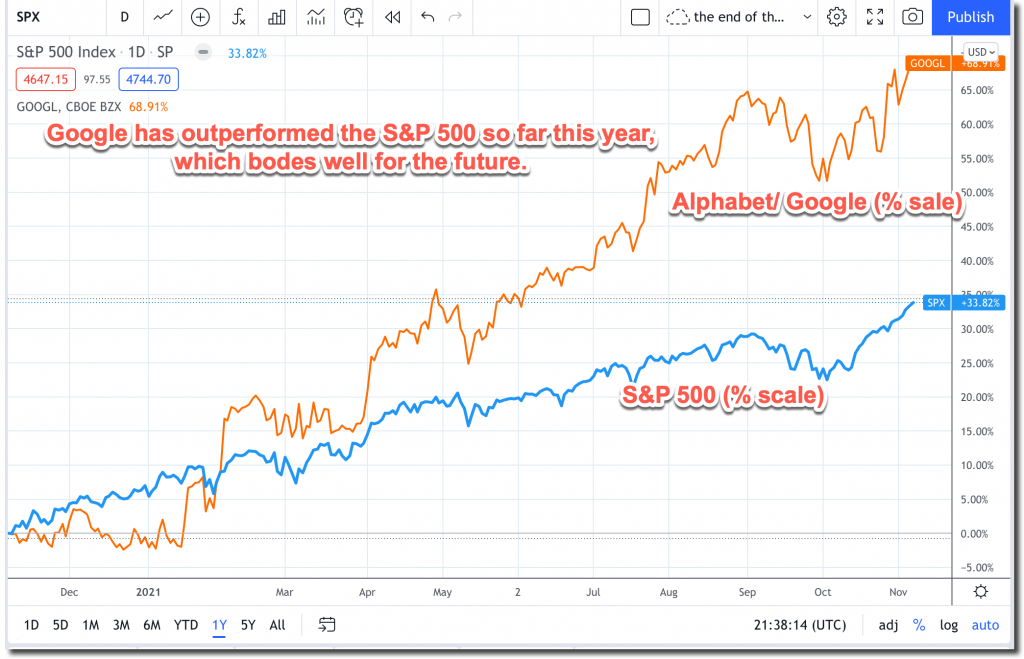

Alphabet: The Google parent had a bullish technical development last week, when it broke out of its short-term range above $2960, which opens the way to further gains. Momentum indicators are also suggesting further gains could be on the cards, which is another positive development for this stock. After some extremely impressive earnings so far in 2021, earnings growth has averaged some 125% over the past three quarters, earnings growth is expected to grow by a magnificent 102% in 2021, and momentum is expected to be retained in 2022, with another 5% in earnings growth expected by analysts. Added to this, Alphabet’s share price is up some 70% so far this year and has outperformed the overall S&P 500, as you can see in the chart below. When a stock is outperforming the overall market and the market is in a strong position, then this suggests that momentum is on the stock’s side. This is why we continue to think that Google can outperform, especially as we move into the last few weeks of the year, which, historically, can be a strong period for stocks.

-

Atlassian: The Aussie software development and collaboration tools specialist is definitely one to consider as we move into the final months of the year. This stock has been on a rollercoaster of late. Its stock price hit a record high at the end of last month, after stunning Q3 results, however, it has lost its way since the start of November. We think that this will be a short-term phenomenon only, as Atlassian’s products are perfect for the post-Covid world of work: they work well for office-based work, home-working and a hybrid model. They should also do well as business travel is re-imaged, with more teams around the world preferring to use technology for meet-ups rather than flying around the world, busting green credentials for meetings. It announced more than 200,000 customers for Q3, a 30% increase compared to 2021, revenues also hit a record above $600mn for the quarter. It is also moving into new areas including IT maintenance systems, which should bode well for future earnings. Although its stock price has been on a tremendous run and has more than doubled in the last 12 months, we still think that there is plenty more to go for this Nasdaq-listed stock.

Chart 1: