USD/JPY regains its poise on rising US bond yields

Policy divergence between major central banks was a key FX theme last year and this remains the case as we move out of the pandemic and rate rises in the US become a reality.

Today’s Bank of Japan meeting again highlighted this narrative, disappointing hawkish expectations even if it did tweak some of its language.

We know the Fed has now shifted gear into battling persistent inflation and markets are rapidly pricing in four 25 basis point rate hikes for this year after the world’s most powerful central bank tapers its bond buying program. The market has tended to sell the dollar around recent key data releases like non-farm payrolls and CPI, but it has stabilised over the last few sessions after tumbling out of its recent range.

BoJ remains dovish

In contrast, the Bank of Japan left its policy parameters unchanged this morning, frustrating those who were hoping for more hawkish action. Policymakers did change the balance of inflation risks from “tilted downwards” to “balanced”, for the first time since 2014. This means they see equal risks for prices to overshoot target.

But there were only very marginal CPI forecast revisions to 1.1% for 2022 and 2023, from 0.9% and 1.0% respectively.

This hardly points to an imminent change in the bank’s ultra-dovish stance as the 2% inflation target remains a long way off.

USD/JPY finds a bid but will remain volatile

JPY was the worst performing major currency last year, down over 10% versus the greenback. Relatively kind risk sentiment, the energy shock and of course, higher US rates have all hurt the yen. The very recent ramp up in bond yields is also taking its tolls, as USD/JPY closely correlates with long US Treasury yields so it is worth watching to see how high rates can go as a near-term catalyst.

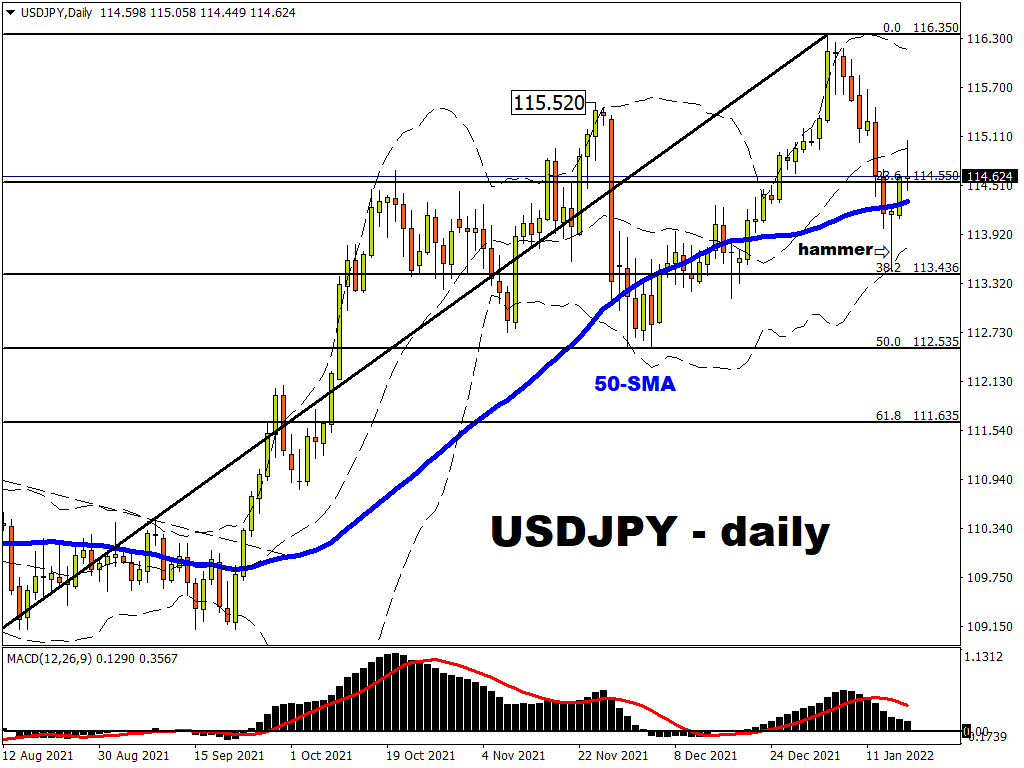

USD/JPY climbed to highs at 116.35 at the start of the year, a level last seen in January 2017. But the bullish move above the previous high at 115.52 could not be sustained and price tumbled quickly, falling seven days out of eight until yesterday.

A notable hammer candlestick printed on Friday after the major sunk to a three-week low at 113.48. This is a bullish trading pattern as buyers absorbed the selling pressure and then pushed the market back near to the opening price. Prices moved back above the 50-day simple moving average and are now sitting on the trendline from the September low. Bulls will look to the November high at 115.52, and the early January high if US bond yields continue to rise.

However, a prolonged stock market selloff may help the yen find some support, at 113.48 and around 113.