Week Ahead: Can NZD, AUD extend August gains vs USD?

Besides the US Dollar, the antipodean currencies will also be vying for the limelight in the coming week the. This is due to key events such as the RBNZ policy decision, the RBA meeting minutes, and the Australian employment data, all due in the coming days alongside these other potential market-moving events:

Monday, August 16

- Japan industrial production, GDP

- China industrial output, retail sales

Tuesday, August 17

- Reserve Bank of Australia policy meeting minutes

- Eurozone GDP

- US retail sales, industrial production

- Fed Chair Jerome Powell speech

Wednesday, August 18

- RBNZ policy decision

- EIA crude oil inventory report

- FOMC minutes

- Dallas Fed President Robert Kaplan speaks

Thursday, August 19

- Australia unemployment rate

- US weekly jobless claims

Friday, August 20

- Japan CPI

- China loan prime rate

- UK consumer confidence, retail sales

- Canada retail sales

Note that NZD and AUD are leading G10 currencies that can currently boast month-to-date gains against the UD dollar.

Hawkish RBNZ to fuel more NZD gains?

The Kiwi has been fueled by rising expectations that the Reserve Bank of New Zealand is set to hike its interest rates. Markets are already betting on 3 rate hikes by February 2022, thanks to rising inflation and a robust jobs market. The July unemployment rate by 0.7 percentage points down to 4%, far better than the market-estimated 4.4%. The 2Q CPI came in at 3.3%, breaching the RBNZ’s target range of 1-3%.

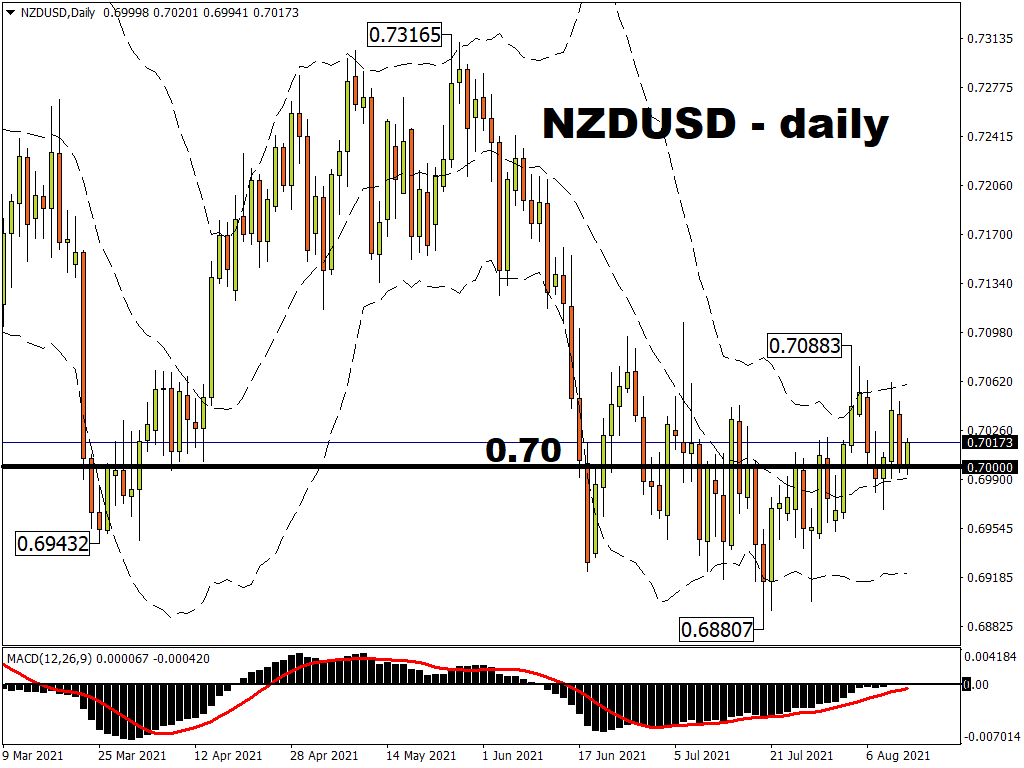

The increasingly hawkish RBNZ has served as a tailwind for the Kiwi as it posted a month-to-date advance against all of its G10 peers. NZDUSD was also pushed into testing its upper Bollinger band in several sessions so far in August.

Should a rate hike indeed materialize over the coming week, that should help solidify NZDUSD’s presence above the psychologically-important 0.70 mark.

Jobs data to heap more pressure on AUD?

Recall that at the Reserve Bank of Australia’s August meeting, policymakers surprised markets by sticking to their tapering plans despite the ongoing lockdowns across the nation. Despite such hawkish overtones, markets are cognizant of the downside risks stemming from measures to curb the Delta variant’s spread.

Against such a backdrop, Australia’s economic calendar in the week ahead is set to show 46.2k jobs lost in July, with the unemployment rate ticking up higher to 5% from 4.9% in June. It remains to be seen how the RBA takes these data points into account at its 7 September meeting, and whether it can still afford to stick to its tapering plans.

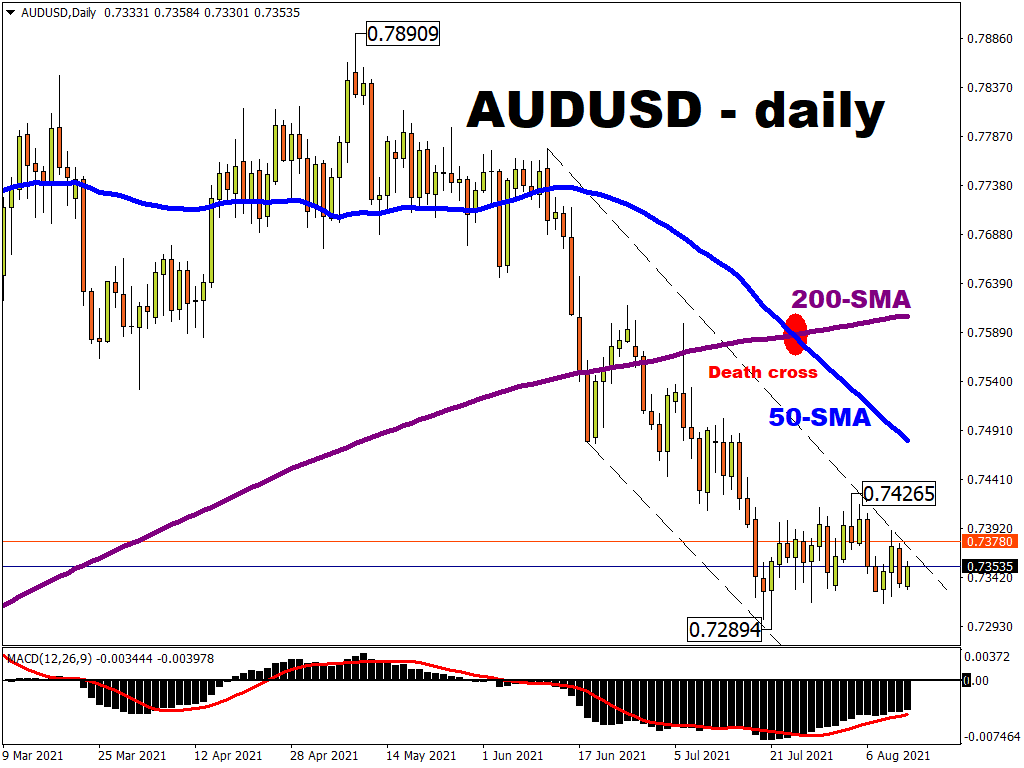

In the meantime, as long as the virus-curbing measures stay in place, it could keep AUDUSD within its downtrend and prone to more downside. Having already formed a death cross, AUDUSD could even set a new year-to-date low in sub-0.73 domain.

AUDNZD may best capture widening Australia-New Zealand gap

The potential policy divergence between the RBA and the RBNZ is perhaps best encapsulated in AUDNZD as opposed to stacking either currency against the US dollar. After all, the heightened expectations for the US Federal Reserve to taper its asset purchases sooner rather than later is strengthening the bullish case for the US dollar.

If the Australian economy is shown to be faring worse-than-expected relative to its neighbour down south past the Tasman Sea, that is likely to better manifest in more downside for AUDNZD. This currency pair has already been flirting with oversold conditions in recent sessions, though the December low may still loom closer if the economic and policy gap widens between Australia and New Zealand.