Week Ahead: Hawkish Fed puts markets in new light

The Fed’s hawkish surprise on 16 June now forces market participants to use a different lens while awaiting the scheduled Fed speak, as well as the major economic data and events due in the coming week:

Monday, June 21

- Fed speak: St. Louis Fed President James Bullard, Dallas Fed President Robert Kaplan, New York Fed President John Williams

- ECB President Christine Lagarde speech

Tuesday, June 22

- Fed Chair Jerome Powell testimony before US House subcommittee

- Fed speak: San Francisco Fed President Mary Daly, Cleveland Fed President Loretta Mester

- Eurozone consumer confidence

Wednesday, June 23

- Fed speak: Fed Governor Michelle Bowman, Atlanta Fed President Raphael Bostic, Boston Fed President Eric Rosengren

- Markit PMIs: US, UK, Eurozone

Thursday, June 24

- BOE rate decision

- Germany IFO business climate

- US weekly jobless claims

- Fed speak: Philadelphia Fed President Patrick Harker, Atlanta Fed President Raphael Bostic, St. Louis Fed President James Bullard, New York Fed President John Williams

Friday, June 25

- Fed speak: Cleveland Fed President Loretta Mester, Boston Fed President Eric Rosengren

- US personal income and spending, PCE inflation, consumer sentiment

To recap, FOMC officials are now pencilling in two hikes to US interest rates in 2023. That was a marked shift from the “lower-for-longer” pledge that policymakers have been communicating to markets; they even stuck with the "patience” mantra in the weeks leading up to the June meeting.

The Fed’s dot plot now suggests that the tapering of its asset purchases programme is set to happen sooner than expected, with the much-anticipated unwinding potentially commencing in Q4 of this year.

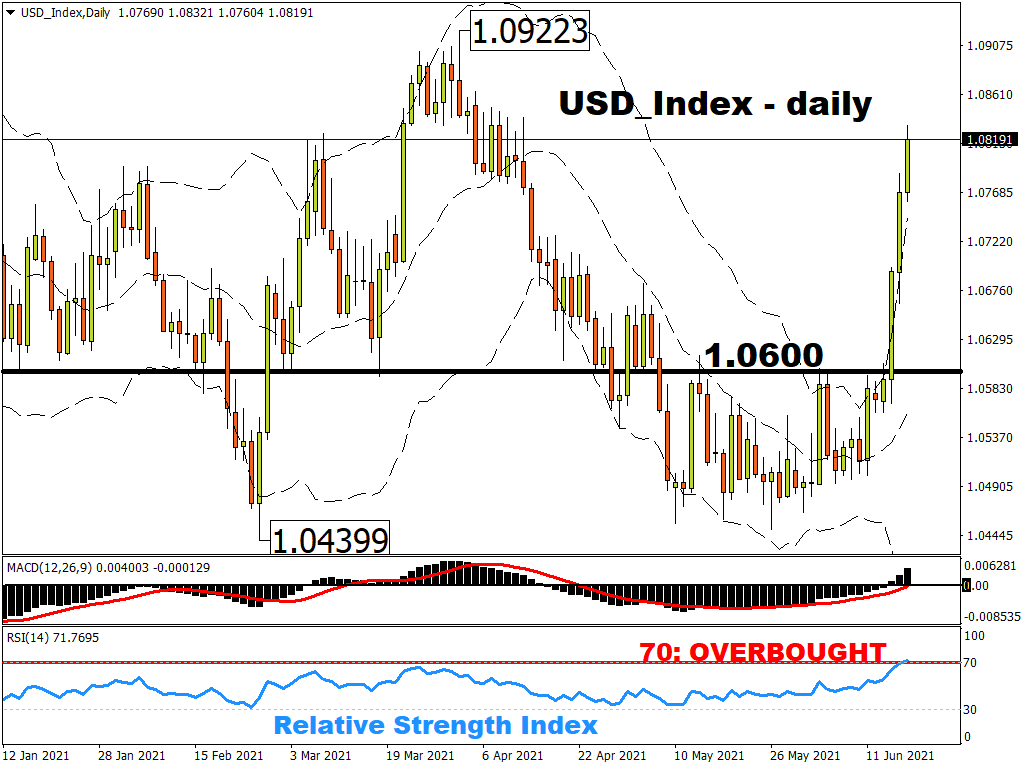

This surprise switch in the Fed’s stance brought dollar bulls back to life, sending it soaring closer towards its 2021 high.

Note that this USD index is an equally weighted index comprising 6 major currency pairs, as opposed to the benchmark DXY which assigns different weightings to its constituents (Euro being the largest at 57.6%, and the Swiss Franc accounting for just 3.6% of the DXY).

From a technical perspective, this USD index has reached overbought levels, judging by the fact that its broken beyond the upper bounds of its Bollinger bands and its 14-day relative strength index has broken above the 70 mark.

Should Fed officials collectively sign from the hawkish hymn book over the coming days, that could spell more upside for the greenback.

Dollar assets are set to remain sensitive to any nuances emanating out of the scheduled Fed speak, though traders might have a tough time reconciling the latest dot plot with any attempts to pour cold water on heightened expectations for the looming tapering.

BOE to deliver another hawkish surprise?

Thanks also to the Fed’s switching tacks, market participants are likely to adopt a different perspective when interpreting monetary policy cues from across the pond as well. Although the Bank of England is roundly expected to leave its policy settings untouched on 24 June, there’s plenty of market chatter now that the BOE could take its cues from the Fed.

Already, the Bank of America, HSBC Bank, and Credit Suisse are moving their UK rate hike expectations forward to next year. This is a far cry from the narrative circa end-2020, when market participants were contemplating the prospects of negative interest rates for the UK coming into this year.

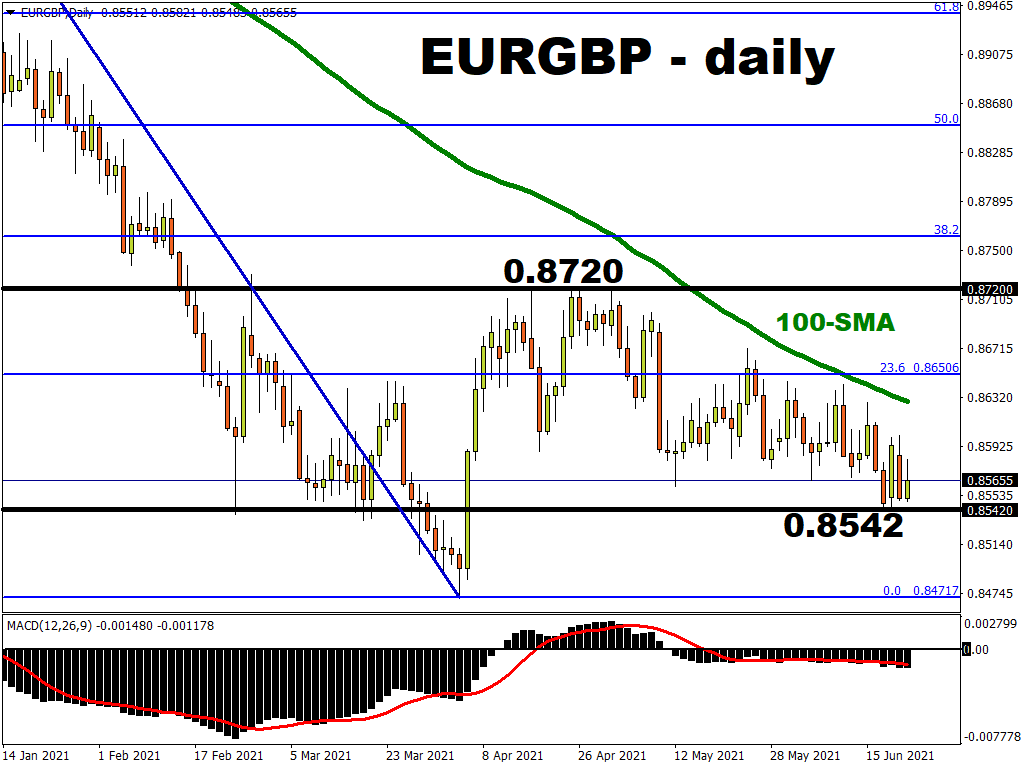

Should the BOE indeed deliver on yet another hawkish surprise for markets to contend with, that could see EURGBP testing a key Q1 support level around the 0.8535 mark, failing which could see this currency pair chart a path towards its year-to-date low.