Week Ahead: Hot CPI could boost dollar after soft NFP report

The week ahead promises to be eventful thanks to key economic reports from major economies and speeches from financial heavyweights.

But before we take a deep dive into what to expect over the next few days, let's briefly discuss the latest US non-farm payrolls data.

US job growth appeared to lose momentum in November, in a sign that hiring started to slow ahead of the Omicron threat. Nonfarm payrolls increased by just 210k, much lower than the forecasted 550k figure. Despite the massive miss, the unemployment rate fell to 4.2% from 4.6%. However, average earnings in November dipped from 0.4% to 0.3% month over month - leaving the annual pace of wage growth unchanged at 4.8%.

Investors who were expecting fireworks were left empty-handed as markets offered a fairly muted reaction to the jobs data. We saw the Dollar Index (DXY) whipsaw within a 50 pip range, with the same action witnessed on gold before prices later pushed higher. The S&P500 concluded Friday’s session negative after a fairly rough trading week while oil weakened for a sixth straight week.

November’s reports may complicate things for the US Federal Reserve who remains on a path towards tightening monetary policy in the face of rising inflation.

Check out the scheduled economic data releases and events for the coming weeks:

Monday

- AUD: Australia inflation gauge, ANZ job advertisements

- EUR: Germany factory orders, construction PMIs

- GBP: UK construction PMIs

- GBP: BOE’s Ben Broadbent speaks

Tuesday:

- CNH: China trade data

- JPY: Japan cash earnings, household spending, leading index

- AUD: Reserve Bank of Australia policy decision, consumer confidence

- EUR: Eurozone GDP, Germany ZEW survey expectations, industrial production

- USD: U.S trade data

Wednesday:

- CAD: Bank of Canada rate decision

- EUR: ECB President Christine Lagarde speaks

- JPY: Japan bank lending, BoP, GDP, bankruptcies

- US crude: EIA weekly US crude oil inventory report

Thursday:

- CNH: China CPI, PPI, money supply, new yuan loans

- USD: US President Joe Biden holds summit for Democracy

- USD: U.S. wholesale inventories, initial jobless claims

Friday:

- JPY: Japan PPI

- GBP: UK industrial production, GDP, BOE inflation attitudes survey

- USD: US CPI, university Michigan consumer sentiment

Inflation remains hot in the United States with consumer prices surging to 6.2% in October, the highest in more than three decades. The inflation report for November is expected to show CPI surging to 6.7% thanks to persistent supply chain issues, higher energy costs and strong consumer demand.

Another surge in US consumer price inflation may rekindle market expectations over the Federal Reserve raising interest rates more quickly than expected. Traders are currently pricing in a 56% probability of at least one rate hike by early May 2022 and an 87.5% probability by mid-June next year. Dollar bulls could be injected with renewed confidence to rattle the FX space if the CPI meets or exceeds expectations.

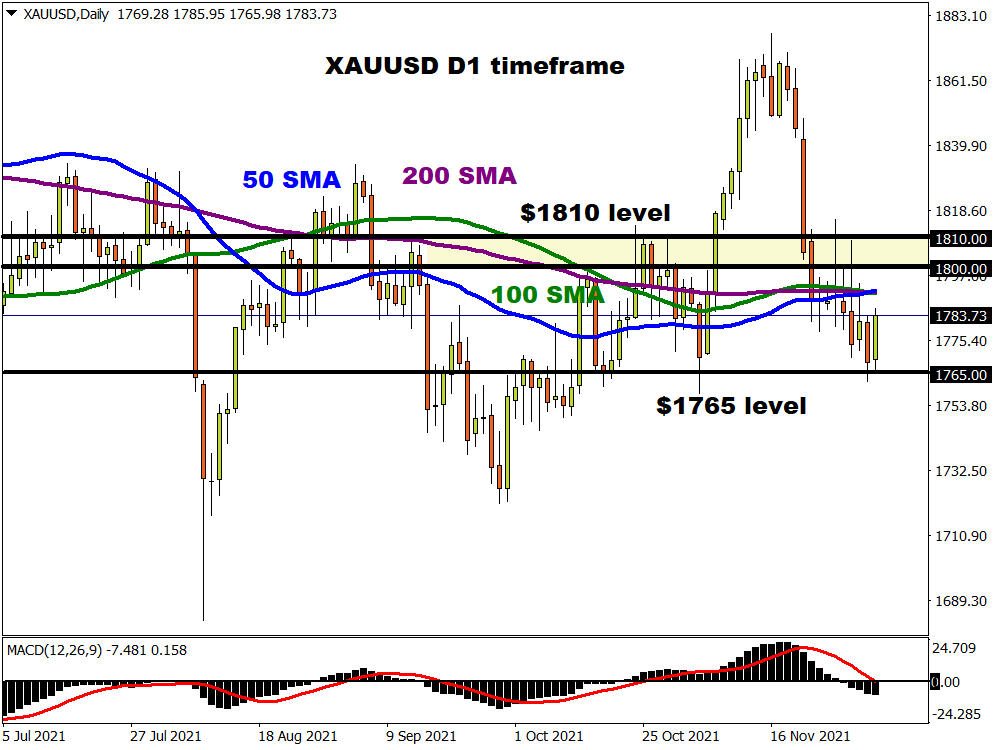

Commodity spotlight – Gold

Gold prices have been trapped within a wide range on the daily charts with support at $1765 and resistance around $1810. It feels like the precious may be waiting for a fresh directional catalyst before embarking on its next big move. In the meantime, there is a head and shoulders technical formation with support around $1765. If price action trumps on Monday, a rebound back towards $1800 - $1810 could be on the cards.