Week Ahead: Next US inflation marker

Before we look at the coming week, it’s imperative that we take stock of the just released US nonfarm payrolls figure. And it’s perhaps not as straightforward as expected.

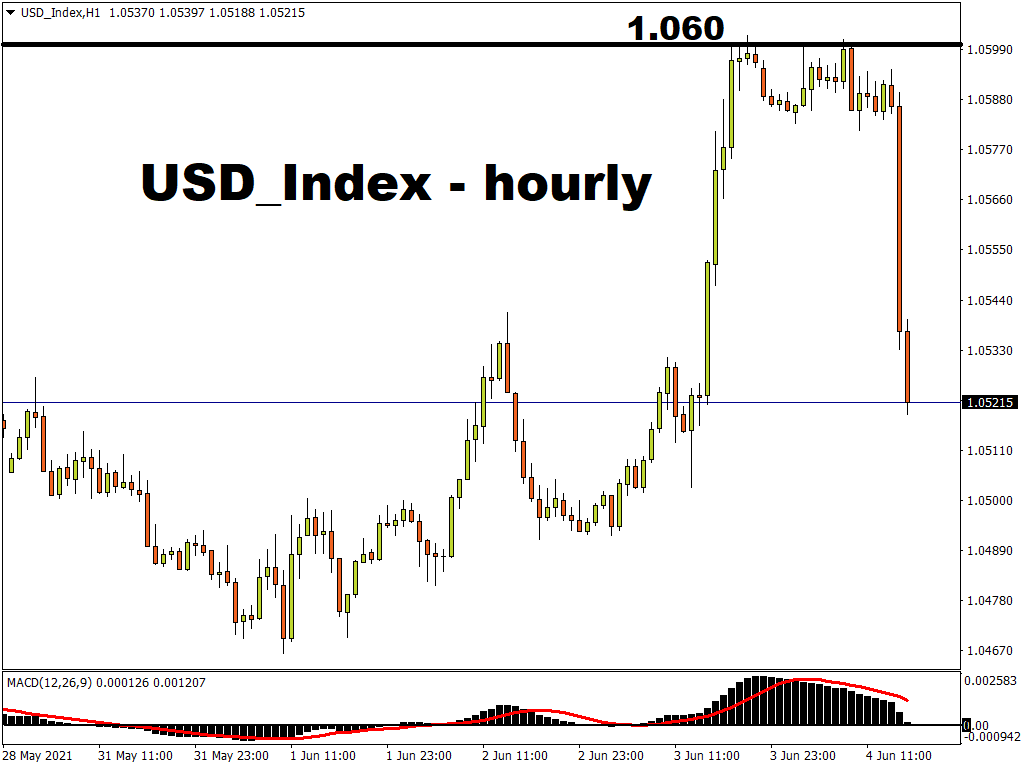

The headline NFP print was 559,000; just below the market’s estimates of 675,000. Taken at face value, that headline figure triggered some dollar weakness, as markets unwound their optimism for a blockbuster NFP. The initially weaker dollar supports the narrative that a slower-than-expected jobs recovery should stave off inflationary pressures while giving the Fed more runway before policymakers have to start easing up on their bond purchases.

However, looking under the hood of the latest US jobs report, one would find enough points to argue that there are enough signs of inflation making a comeback.

The unemployment rate fell to 5.8%, which was lower than expected. Also, hourly earnings exceeded market expectations (0.5% month-on-month, and 2% year-on-year). Considering that wages are being pushed up due to a lack of workers, these elevated wages could lead to cost-push inflation.

Still, markets appear to be latching on to the headline figure, and also the fact that about 7.6 million American workers remain unemployed. That sobering fact should ensure that the Fed stays the course with its ultra-accommodative stance, keeping Treasury yields and the buck subdued for a while more, while supporting US stocks.

With all this in mind, we could be in for a tense Thursday ahead as investors await the release of the May US consumer price index, along with a healthy dose of other major events in the coming week:

Monday, June 7

- China trade

- Germany factory orders

Tuesday, June 8

- Eurozone Q1 GDP (final)

- Germany industrial production

- Japan Q1 GDP (final), trade balance

Wednesday, June 9

- Bank of Canada rate decision

- EIA crude oil inventories

- China CPI, PPI

Thursday, June 10

- European Central Bank rate decision

- US-Iran nuclear talks resume

- OPEC’s monthly Oil Market Report

- US inflation, initial jobless claims

Friday, June 11

- G7 summit begins

- UK industrial production

- US consumer sentiment

ECB unlikely to rock the boat

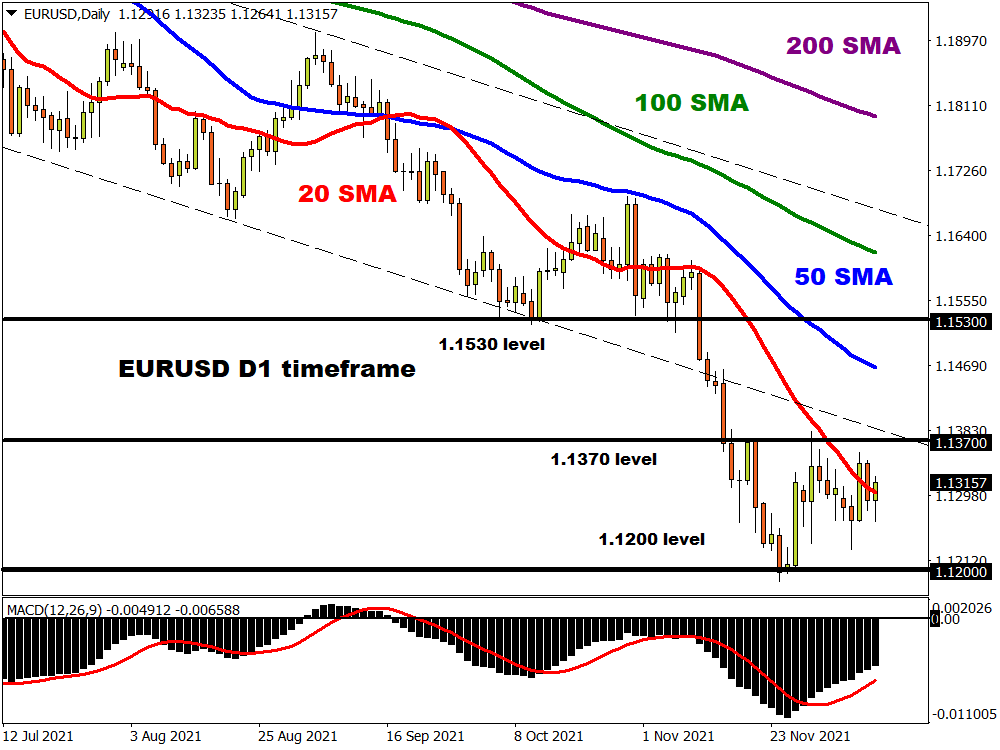

The European Central Bank isn’t expected to tweak its bond purchases at the June meeting, which leaves EURUSD more exposed to happenings on the other side of the Atlantic on Thursday.

Another higher-than-expected US consumer price index, coupled with a lower-than-expected US weekly jobless claims, could pull the world’s most-traded currency pair further below the 1.22 mark.

Should the 1.21 Fibonacci line fail as a support level, EURUSD should still find plenty of support around the 1.20 region, considering that the Fed wouldn’t want to drastically alter its dovish tune too soon.