Week Ahead: NZDUSD to breach 50-SMA on larger RBNZ hike?

Here are the scheduled economic data releases and corporate events that could move markets in the coming week:

Monday, November 22

- CNY: China loan prime rate

- EUR: Eurozone November consumer confidence

- USD: President Biden to announce Fed Chair this week?

- Zoom Q3 earnings (after US markets close)

Tuesday, November 23

- GBP: BOE’s Jonathan Haskel speech, UK November PMIs

- EUR: Eurozone November PMIs, Germany Q3 GDP (final)

- USD: US November PMIs

- Dollar Tree Q3 earnings (before US markets open)

- Best Buy Q3 earnings (before US markets open)

- XPeng Q3 earnings (before US markets open)

- Analog Devices Q3 earnings (before US markets open)

- HP Q3 earnings (after US markets close)

- Dell Q3 earnings (after US markets close)

Wednesday, November 24

- NZD: RBNZ rate decision

- USD: US weekly initial jobless claims, 3Q GDP (second estimate), October personal income and spending, October PCE deflator, November consumer sentiment (final print)

- US crude: EIA weekly US crude oil inventory report

- USD: FOMC minutes release

Thursday, November 25

- NZD: New Zealand October trade

- EUR: Germany December consumer confidence

- EUR: ECB President Christine Lagarde speech

- GBP: BOE Governor Andrew Bailey speech

- Thanksgiving Day: US markets closed

Friday, November 26

- AUD: Australia October retail sales

- GBP: BOE Chief Economist Huw Pill speech

- EUR: ECB President Christine Lagarde speech

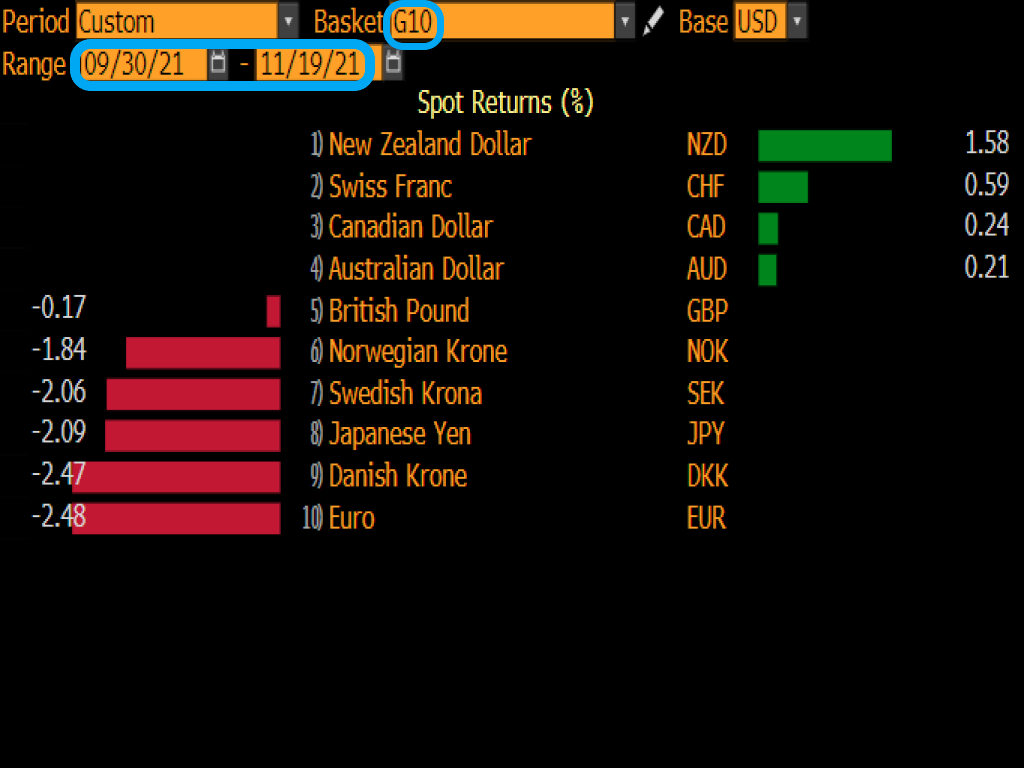

Note that the New Zealand dollar is the best performing G10 currency against the US dollar so far this quarter.

The Kiwi’s fortunes had been helped by a hawkish central bank. Last month, the Reserve Bank of New Zealand raised its official cash rate by 25 basis points to 0.5%, making it one of the first major central banks to embark on policy tightening since the pandemic. The hike enabled NZD to post a quarter-to-date advance against all its G10 peers.

For the upcoming week’s rate decision, markets are widely expecting policymakers to raise rates once more.

After all, two-year inflation expectations as of this quarter have risen to their highest in a decade (2.96% in Q4 2021 vs. 3% in Q2 2011). That’s on the upper-end of the central bank’s target band, with policymakers preferring to keep it around the midpoint. Such figures add to the impetus for the RBNZ to embark on a more aggressive tightening cycle, which in turn should strengthen support for the Kiwi. Even before the latest NZ inflation data, leveraged funds have already been the most bullish on the NZD’s prospects since 2018, according to CFTC data.

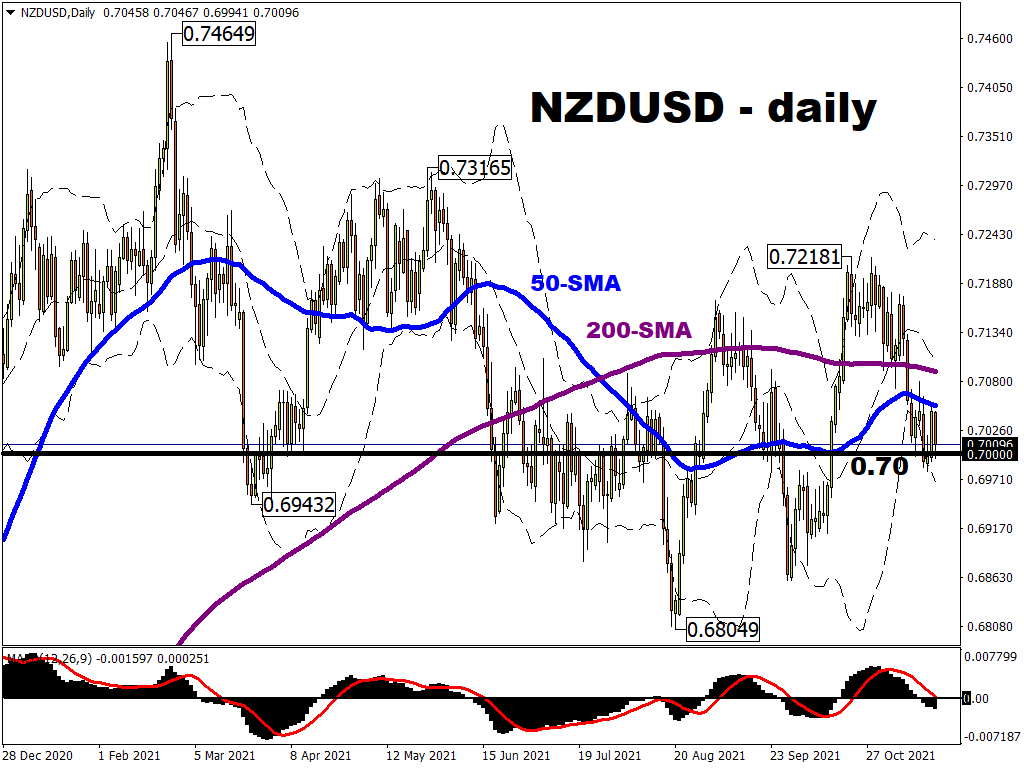

Still, the Kiwi’s outperformance in recent months may be lost when merely glancing at the daily charts of the NZDUSD. After all, the US dollar has been surging as well, as markets expect US inflationary pressures to force the Fed into also adopting a more hawkish stance.

Still, should the RBNZ ramp up its rate hikes, say by 50 bps in the coming week as opposed to the customary 25 bps, that could the excuse that kiwi bulls need to test NZDUSD’s immediate resistance level around its 50-day simple moving average.

Stronger resistance may come at its 200-day SMA which currently lies just shy of the 0.71 level. This also assumes that the psychologically-important 0.70 line shows enough resilience as a key support level and serve as the launchpad for another cycle higher.

The USD side of the equation would also have a major say on how this currency pair fares over the near-term. With markets having to digest a slew of US economic data after the RBNZ’s decision (and before investors and traders go off to feast on their Thanksgiving meals), further signs of an overheating US economy could spur the greenback higher while potentially snuffing out any post-RBNZ gains for the kiwi.