Week Ahead: US inflation to bolster USD bulls?

Before we look at the coming week, let’s first dive into this blockbuster US nonfarm payrolls report that was released about an hour ago.

- The July NFP figure of 943,000 – the highest headline print since August 2020 - smashed the forecasted 870k figure!

- June’s NFP was also revised upwards to 938,000 compared to the initial 850k announced on the first Friday of July.

- Last month, the unemployment rate fell by 0.5 percentage points to 5.4%, which is now much lower than the pandemic peak of 14.8% in April 2020.

- Perhaps the most important figure in some Fed officials’ eyes: the US jobs market is also now just 5.7 million away from the pre-pandemic peak.

The numbers above should go some ways towards the “substantial further progress” in the jobs recovery that the Fed demands as a precursor to its actual tapering.

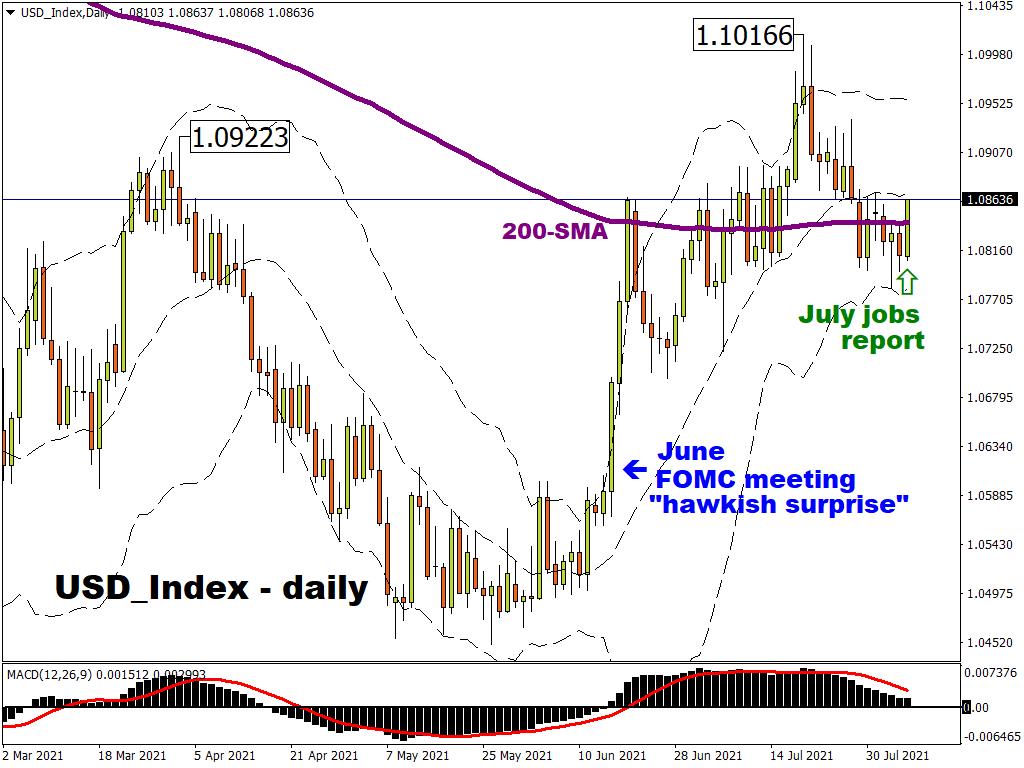

This positive surprise in the US nonfarm payrolls report has spurred the equally-weighted US dollar index into breaching its 200-day simple moving average resistance level.

Armed with these latest readings on the US jobs market, that would frame market expectations as they brace for the Fed speak and the July US CPI data due in the coming week, along with these other potential market-moving events:

Monday, August 9

- Japan markets closed

- China CPI, PPI

- Germany external trade

- Fed speak: Atlanta Fed President Raphael Bostic, Richmond Fed President Tom Barkin

Tuesday, August 10

- Australia business confidence

- Germany ZEW survey expectations

- Fed speak: Cleveland Fed President Loretta Mester

Wednesday, August 11

- EIA crude oil inventory report

- Fed speak: Atlanta Fed President Raphael Bostic, Kansas City Fed President Esther George

- US CPI

Thursday, August 12

- OPEC monthly oil report

- Eurozone industrial production

- UK industrial production, 2Q GDP

- US weekly jobless claims

Friday, August 13

- Eurozone trade balance

- US consumer sentiment

Commentary by Fed officials in the coming week would be further scrutinized in light of this positive surprise in the US nonfarm payrolls report.

Should more and more Fed officials start singing a hawkish tune, that could really push the US dollar closer towards its year-to-date high.

While Fed officials have often deemed US inflationary pressures to be “transitory”, another strong CPI print could give the hawks added reason to taper sooner rather than later. That should translate into rising yields and a stronger dollar, at the expense of spot gold prices.

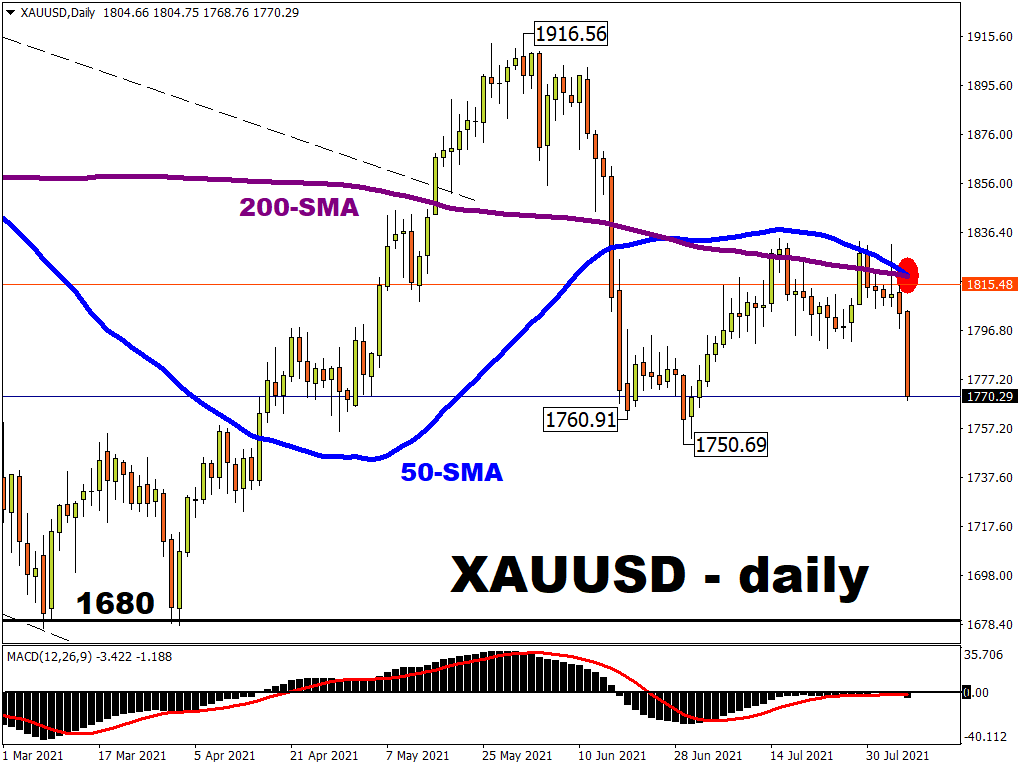

On the back of today's NFP upside surprise, bullion is on the cusp of forming a 'death cross' (50-day simple moving average crossing below its 200-day counterpart).

When such a technical event is confirmed, that could herald even more declines for this precious metal, which is already about to wrap up its biggest weekly decline (-2.6%) since the week of the hawkish surprise from the June FOMC meeting and is now trying to find support around its 23.6% Fibonacci retracement level from the August 2020 record high.