Week Ahead: Will OPEC+ stop oil’s drop?

Here are the scheduled economic data releases and corporate events that could move markets in the coming week:

Monday, November 29

- JPY: BOJ Governor Haruhiko Kuroda speech, Japan October retail sales

- EUR: Germany November CPI

- Brent: Iran nuclear talks resume in Vienna

- USD: Fed speak – Fed Chair Jerome Powell, New York Fed President John Williams

Tuesday, November 30

- CNY: China November manufacturing and non-manufacturing PMIs

- JPY: Japan October industrial production, unemployment

- EUR: Eurozone November CPI, Germany November unemployment

- GBP: BOE’s Catherine Mann speech

- USD: Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen testify in US Senate

- USD: US November consumer confidence

- CAD: Canada September GDP

Wednesday, December 1

- AUD: Australia 3Q GDP

- CNY: China November Caixin manufacturing PMI

- GBP: BOE Governor Andrew Bailey speech

- USD: Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen attend House hearing

- USD: US November ISM manufacturing

- US crude: EIA weekly US crude oil inventory report

Thursday, December 2

- AUD: Australia October trade

- Brent: OPEC+ meeting

- EUR: Eurozone October unemployment, PPI

- USD: Fed speak – San Francisco Fed President Mary Daly, Richmond Fed President Tom Barkin

- USD: US initial weekly jobless claims

Friday, December 3

- CNY: China November Caixin composite and services PMIs

- EUR: Eurozone October retail sales

- USD: US November nonfarm payrolls

Oil markets have been slammed by fears that the latest Covid-19 variant, identified in South Africa, could be a major speed bump in the global reopening. Already, the UK has temporarily halted flights from South Africa, while the likes of the EU, Australia, and Singapore are also looking to restrict entry of travelers from the southern region of the continent.

If such restrictions to cross-border flights are ramped up, that could curb the global demand for oil.

This strikes at the very core of the optimism that had supported oil’s stunning rally since mid-2020.

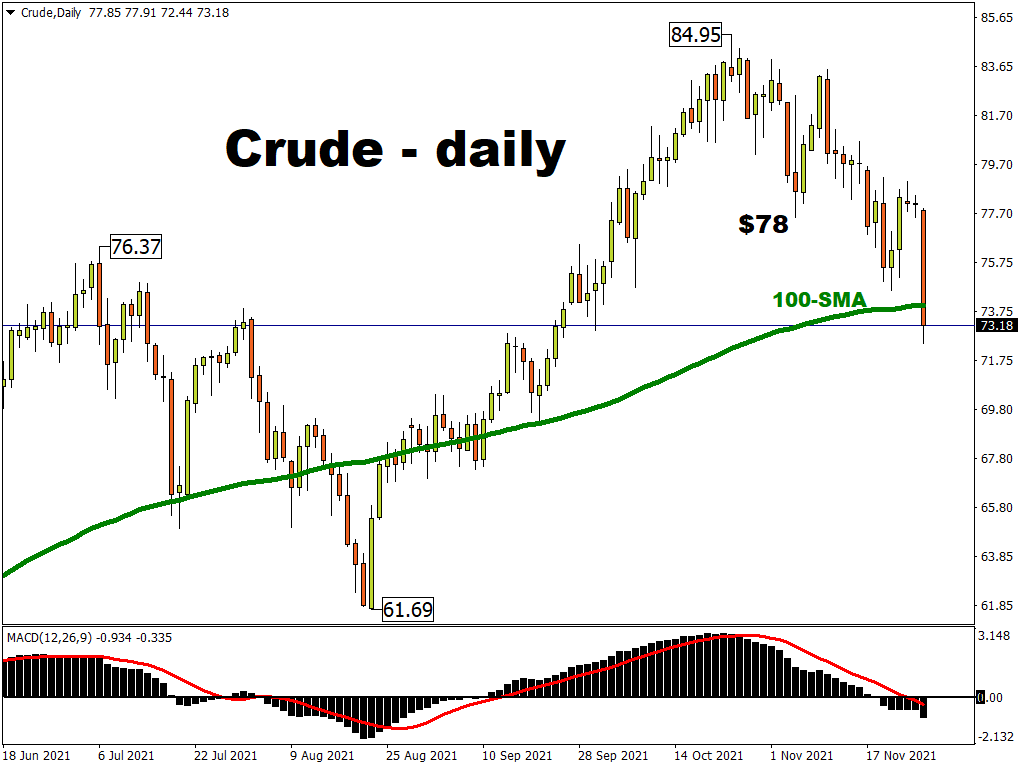

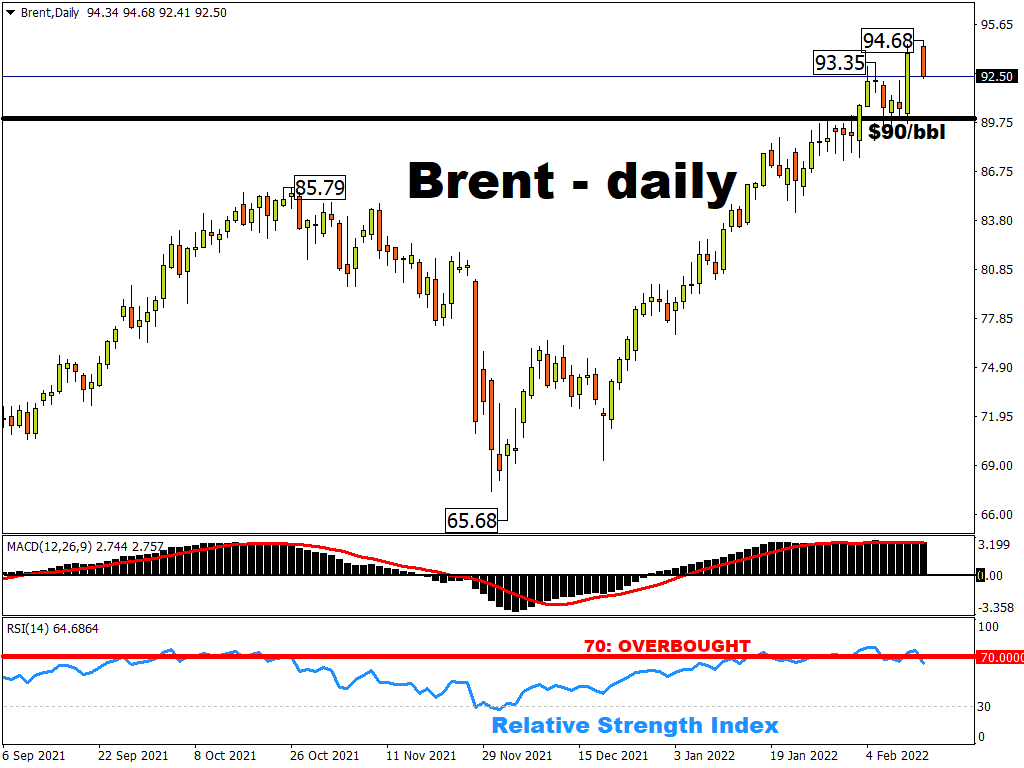

Even though key details about this latest variant are still uncertain, markets haven’t been afraid to sell first before getting the answers to those pressing questions. Oil benchmarks are headed for their fifth consecutive weekly decline, with Friday’s declines wiping out whatever was left of its gains garnered so far this quarter. At the time of writing, Brent is testing its 100-day simple moving average for support.

This latest pandemic-related development is set to be a major topic of discussion during the upcoming OPEC+ meeting, where the alliance is due to decide whether to press ahead with raising their collective output by another 40k barrels next month as intended. On top of that, the alliance also has to take into account the recent announcement by major oil-consuming nations, led by the US, in jointly releasing their strategic reserves in a bid to lower prices at the pump. There could be even more tranches of such coordinated releases by these governments, which could distort plans by OPEC+ to support prices.

It remains to be seen how OPEC+ will take into account all these crucial uncertainties into their decision-making process on December 2nd, which is set to be a major risk event for oil’s near-term performance. Oil’s hope for a major rebound may have to rely on the alliance deciding to halt its output hikes.

Also, there could be headlines hitting markets with Iran set to resume nuclear talks with western parties. Should markets get the sense that Iran is drawing closer to sending its supplies out to global customers, that could add further downward pressure on oil prices, unless fears over the latest Covid-19 strain subside meaningfully in the coming days.