OPEC+ likely to keep with gradual stance amid Ukraine crisis

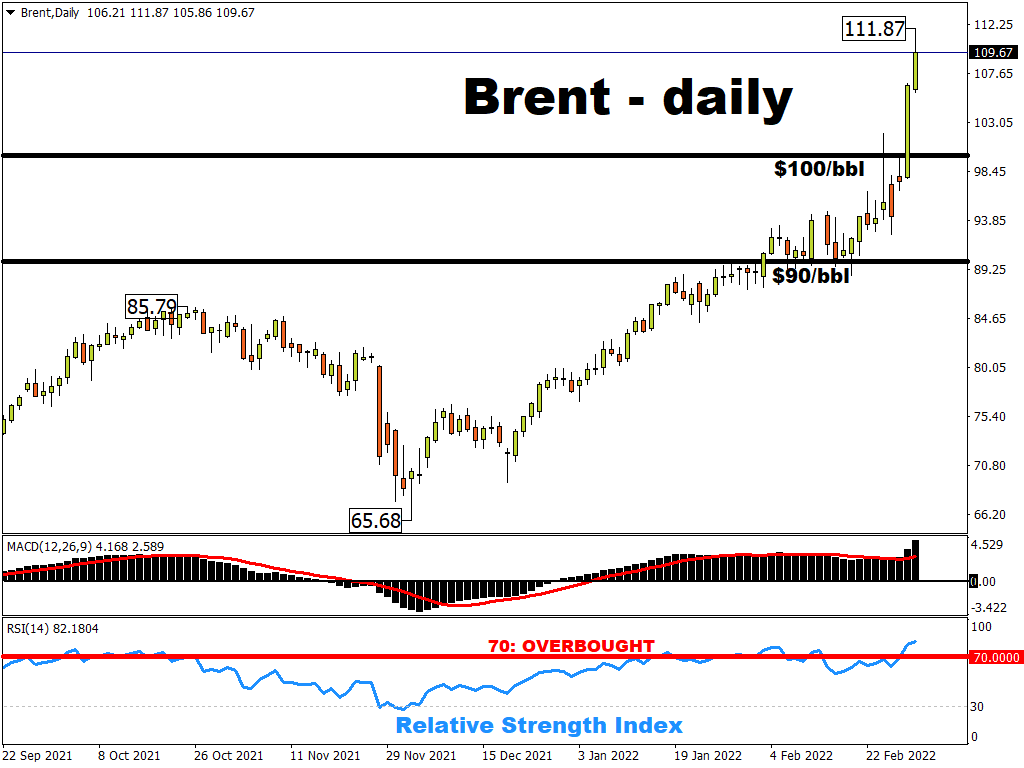

Brent crude oil futures have broken above $110 for the first time since 2014 as OPEC+ prepares to discuss its production plans for April.

The virtual OPEC+ meeting today will be dominated by concerns over the threat of Russia’s oil exports being hit with sanctions. Restrictions on banking transactions already mean around 70% of Russia’s oil exports are finding no buyers.

OPEC+ is caught between Russia’s military attacks in the Ukraine, and the looming prospects of more sanctions from the West that specifically target Russia’s oil.

Although it is widely expected that OPEC+ will proceed with a modest 400k bpd hike next month, markets will be closely monitoring how OPEC+ digests such supply-side risks. At the same time, the alliance must manage Russian sensitivities, as the country is one of its most influential members.

The Ukraine crisis is only solidifying oil bulls’ resolve in pushing prices higher.

Even without the war, and the accompanying threats to strangle Russian oil exports, the oil market structure was pointing to a tightening conditions. Global oil inventories have been falling as supply fails to keep pace with the recovery in demand.

Powell’s position on rate hikes under scrutiny

The Ukraine crisis isn’t just reverberating throughout global financial markets, but also likely forcing a rethink among major central banks in their battle against inflation. Before Russia invaded Ukraine, major economies were already having to contend with inflation reaching multi-decade highs; the Ukraine crisis has only poured more fuel onto the inflation fire.

However, instead of proceeding with the conventional policy response of hiking interest rates, central banks now have to take into account the added risks stemming from Russia’s military actions. The Ukraine crisis has ramped up the prospects of a policy mistake by central banks who now have to tread carefully, between subduing inflation while remaining sensitive to fresh downside risks to the economy.

Set within this context, Fed Chair Jerome Powell’s testimony on Capitol Hill this week will be closely scrutinised for how the FOMC intends to navigate such a precarious policy landscape.

Already, markets have pared back their hawkish bets substantially on rate hikes.

At the time of writing, Fed Funds futures have ruled out a 50-basis point hike by the Fed this month, while even a 25-basis point hike is no longer a foregone conclusion. Some segments of the markets think the ever-evolving Ukraine crisis may force the FOMC to sit on their hands this month.

Such a dovish outcome may offer some fleeting relief for global stocks, which have been battered by Europe’s worst security crisis since World War 2. However, as long as fears persist over escalating geopolitical tensions that contribute to stagflation concerns, risk-taking activities are expected to remain muted in the interim.