How Trading works

Trading was once viewed as the exclusive domain of professionals huddled over computer screens in the high towers of New York, London and Tokyo. But times have changed. The opportunities of the financial markets are now available to anyone with a computer or mobile phone. Today, anyone can learn to trade and millions of us are – in fact more people traded for themselves in 2020 than ever before.

Here’s a short introduction to how trading works to get you started.

Trading vs investing

You often hear the terms ‘investing’ and ‘trading’. They have similar meanings, and are often used interchangeably. But there is a difference - if you’re buying shares or another asset for the longer term in the hope that it will rise in value, you’re investing. On the other hand, if your strategy is to profit from the short-term ups and downs of the markets, you’re trading. People often think they need to make a choice between being an ‘investor’ or a ‘trader’ but we believe that the key to delivering results over time is to combine longer term investments with short term higher risk trading that has the the potential for returns in any market conditions.

Understanding primary and secondary markets

Primary markets are where governments and companies sell their shares or bonds directly to investors. The main primary market transactions are initial public offerings (IPOs) – which is when a company first lists its shares on a stock exchange – and private placements when a company sells shares directly to individuals. Primary markets serve institutional investors like pension funds and insurance companies who are managing vast sums of money on behalf of many individuals.

Secondary markets are where most traders and investors buy and sell securities – this is where the action is. Examples of secondary markets include stocks exchanges such as the NYSE or NASDAQ. Secondary markets are where many of the big movements in the financial markets happen, creating opportunities for you to make money.

Just like any market, they’re designed to make it easy to find what you’re looking for.

Shares or futures are found in order-driven markets. In these markets trades are arranged using rules that match buyers and sellers, and these markets usually have settlement systems in place to ensure that both sides complete on their obligations. This allows complete strangers to buy and sell assets from each other and ensure that all assets and funds are exchanged correctly.

Meanwhile most bonds, currencies and commodities are found in quote-driven markets. These are also known by their more common name: over the counter, or OTC. They’re called quote-driven because the price you pay is 'quoted' by the dealer.

Last but not least, brokered markets are where you can buy assets that are rare or unique - in these markets a broker arranges trades between his clients.

Understanding short selling

Purchasing something in the hope that it will rise in value is known as ‘going long’ and easy to understand.

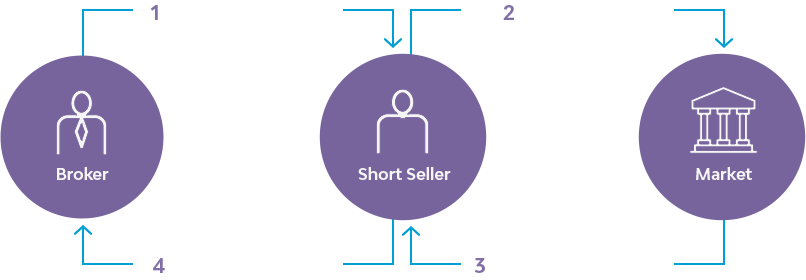

Short selling is slightly less intuitive. When you short sell, you’re hoping that an asset will drop in value while you’re holding it.

Here’s how the transaction works: To take a short position, you are borrowing the asset from someone who has a long position, so that you can sell it. Then, at some point in the future, you complete the transaction by buying back the asset and returning the asset you borrowed to the lender. Your goal is to buy back the borrowed shares for less than you sold them for.

Short selling is a way to profit when you expect a company to perform badly. But shorting stocks through order driven markets (stock exchanges) is an adventurous game. That’s because your gains are limited to a maximum of 100% of your initial investment, whereas your potential losses are unlimited. If the stock soars after you borrowed it, you’re still on the hook for buying it back.

For most retail investors, a less risky and more accessible option way of short selling is a CFD. With these, you can still earn money if the stock loses value, but you can limit how much you risk with a 'stop loss'. CFDs are traded on OTC markets and were designed specifically to make financial markets more accessible for retail traders.

For most retail investors, a less risky and more accessible option way of short selling is a CFD. With these, you can still earn money if the stock loses value, but you can limit how much you risk with a ‘stop loss’. CFDs are traded on OTC markets and were designed specifically to make financial markets more accessible for retail traders.

What are CFDs and how to trade them

CFDs allow you to trade on the rising or falling prices of financial markets across the globe. Read more

Leverage and how it can be useful

A leveraged trade involves borrowing some of the money you’re using to fund your trade so that you can take a bigger position. It’s also called ‘margin trading’ or ‘trading on margin’. The benefits are obvious: if you invest more, you could earn more. But equally adding leverage will magnify a loss since you still have to repay the full amount you borrowed when you close the deal.

With leveraged trades, you also need to consider borrowing fees. So make sure you understand how leveraged trades work before taking the plunge.

How much does it cost to trade?

Trading is like any other business. If you want to make money, you need to understand all the costs of doing business. And the 'opportunity cost' of not doing it.

When it comes to trading, that means knowing what your transaction costs will be. Here, there are two types of transaction costs: ‘explicit costs’ and ‘implicit ones’.

Your main explicit cost is the transaction fee you pay for each trade. On share trading this is typically a commission fee charged when you buy or sell. On a CFD, the fee can be charged as a commission, or as a ‘mark-up’ on the price. If you’re trading with leverage you’ll also typically pay a small financing fee each day you hold your position. Depending on the markets you trade, access to real time price data may also incur a charge, although any decent broker will give you unlimited access to data with a short delay (minutes).

Secondly, you’ll have implicit costs like the bid-ask spreads. The bid-ask spread is the difference between the price that the CFD broker is willing to buy and sell. It is essentially what you pay the broker to take the initial risk of enabling you to place the trade that you want.

The bid-ask spread is impacted by liquidity, i.e. how much supply and demand there is in the market, and can shift dramatically as the result of an unexpected economic or political event, or a natural disaster such as an earthquake. So it pays to understand the spread and consider how your trading would be impacted by sudden move.

Finally all traders must consider opportunity cost - in economics defined as the cost you incur by not undertaking a course of action. In trading, the opportunity cost is of not seizing a trading opportunity that could make you money.

How to benefit from the financial markets

Today’s choice of trading platforms and apps, real time news & data, retail friendly assets and low costs make it easier than ever to start trading. At Exinity we’re committed to helping you build the knowledge and the confidence to become a competent trader.

The financial markets offer a chance to participate in the global economy – and its future. But like anything, it pays to do your homework before you dive in.