GBP builds a base as the upside surprises

The holiday period is a traditionally low-volatility period for FX, even as the traditional Santa rally in equities plays out. The broader market tone is constructive, guided by generally positive Omicron headlines. This is seeing the safe haven yen underperform while seasonal tendencies look to be kicking in as the dollar struggles to find a conclusive bid against the rest of the G10 currencies

The pound has been enjoying life over the holiday period and has been vying with AUD as the leading major currency over the last few weeks. Potential political upheaval has been averted, for the time being at least, as markets assess both the stability of PM Johnson’s cabinet after numerous lockdown scandals and Brexit policy in the wake of the resignation of chief negotiator, David Frost. This rather grim domestic picture was expected to weigh on sterling, along with record Omicron cases.

Rate hikes and respite

There is now some relief that risks around the new Covid-19 variant are now potentially more manageable. Indeed, yesterday the UK government did not introduce any new social restrictions into the new year for England, even allowing for rising infections and additional measures in other parts of the country.

The surprise rate rise by the Bank of England has also offered some support to GBP.

Indeed, money markets have been piling on bets of more increases over the next year as rates are now expected to climb to 1.25% with four 25bp moves spread broadly across the year. Sterling was quite oversold before the MPC meeting and the overstretched short side may be offering additional support as traders cover their offside positions.

GBP/USD squeeze higher continues

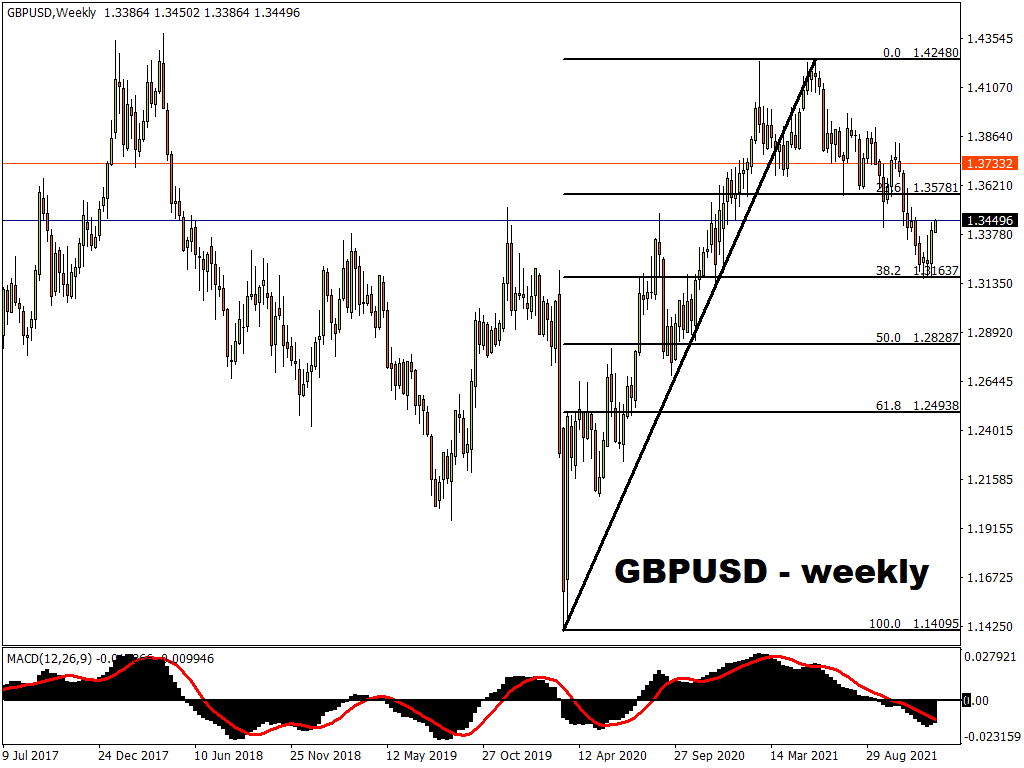

Technically, the convincing case of a near-term base being built in cable now looks more assured. Moves below 1.32 look to have petered out with momentum changing direction and the 38.2% Fib level retracement from 2020 at 1.31637 has capped the downside.

A three-day bullish streak before Christmas lifted GBP/USD above 1.34 to its strongest level in a month. Prices have recently closed above the September low at 1.34109 which is important for more upside. Similarly, a close above the 50-day SMA at 1.3434, which would be the first time since late October. Targets above include the July low at 1.3571 ahead of the declining trendline from the June high.

We note that the dollar does traditionally struggle at this time of the year. It also seems that markets are already fully pricing in the feasible maximum number of BoE hikes for next year.