Week Ahead: Can tech earnings stop the rot for the Nasdaq 100?

US equities have been handed a beating of late, with tech and growth counters bearing the brunt of heightened expectations for a more hawkish Fed.

Risk sentiment would be hoping for some solace from the key economic data releases, events, and US tech earnings due over the coming week:

Monday, January 24

- EUR: Eurozone January PMI

- GBP: UK January PMI

Tuesday, January 25

- AUD: Australia 4Q inflation and December business confidence

- IMF updates World Economic Outlook

- Microsoft earnings

Wednesday, January 26

- US crude: EIA crude oil inventory report

- USD: Fed rate decision

- CAD: Bank of Canada rate decision

- Tesla earnings

- Intel earnings

Thursday, January 27

- CNH: China December industrial profits

- USD: US weekly initial jobless claims and 4Q GDP

- Apple earnings

Friday, January 28

- NZD: New Zealand January consumer confidence

- EUR: Eurozone January economic confidence, Germany 4Q GDP

- USD: US December PCE deflator, personal income and spending, and consumer sentiment

The Nasdaq 100 has officially registered a technical correction after shedding 10% since its highest-ever closing price set on December 27th. Having also broken below its 200-day simple moving average, the index appears destined for the October low in sub-14,400 domain.

While an imminent pullback may be on the cards, considering that the index’s 14-day relative strength index has already careened into oversold territory, technical factors may not be enough to reverse the ongoing declines in tech.

Tech aficionados will be hoping that the likes of Apple, Intel, Microsoft, and Tesla can produce a robust response in their respective earnings releases over the coming week to help pare losses in the broader index.

Still, any positive earnings surprise may not be enough to stem the downward tide for the Nasdaq 100.

Even from a valuations perspective, such comparisons suggest more room to the downside. The Nasdaq 100’s PE ratio is, at the time of writing, at 36 even after the year-to-date declines. That is still above its average PE ratio of 31 over the past 20 years.

Overall, markets are increasingly worried that the Fed has to contemplate even more rate hikes than the three that are already pencilled in for 2022.

These concerns are set to drag tech counters lower, until markets can get further clarity over the Fed’s timeline for rate hikes and possibly even balance sheet reduction.

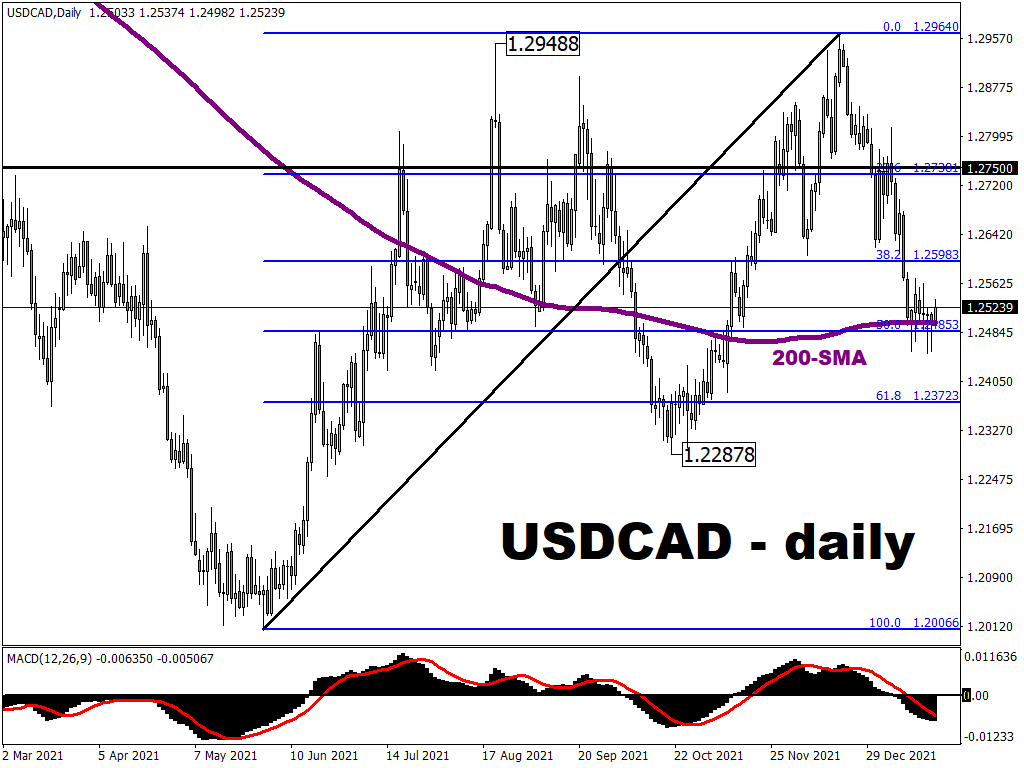

USDCAD to reflect battle of hawks in Fed vs. BoC

The Canadian dollar has the second best start to 2022 among G10 currencies against the greenback. USDCAD has fallen by 0.9% so far this year, thanks to the surge in oil prices and also the market-estimated 77% chance of a rate hike by the Bank of Canada in January. That puts the BoC ahead of the Fed in the policy tightening cycle, with the latter expected to stand pat this month and wait until March before triggering a US rates lift-off.

Note that Canada’s December consumer price index rose by 4.8% year-on-year, its highest reading since 1991. That print is expected to light a fire under policymakers who may have to hasten their rate hikes in order to stem surging inflation.

Although USDCAD is currently finding support at its 200-day simple moving average (SMA), that key technical support could wilt if the Bank of Canada delivers on a rate hike next week.

And if markets believe that a more aggressive rates path lies ahead of the BoC relative to the Fed, USDCAD bears may even drive the pair towards the 61.8% Fibonacci retracement level towards the psychologically-important 1.20 mark.