Week Ahead: Can US stocks, dollar pursue new highs?

Before we consider what’ll feature on the market's radar next week, let’s first take stock of the just-released June US nonfarm payrolls.

The headline June nonfarm payrolls figure of 850,000 exceeded market expectations for 720k, but there’s more than meets the eye. It didn’t quite present the watertight evidence of a rapidly strengthening jobs market that some were expecting.

Note that the unemployment rate actually rose to 5.9% in June (versus the forecasted drop to 5.6%), lending market participants to believe that the US economy is still some ways from showing the “substantial further progress” that would pave the way for an earlier-than-expected easing of the Fed’s support measures. In other words, there was enough reason to think that the latest official US jobs print has given the Fed more slack before it has to taper its asset purchases.

As an immediate response, the Dollar index (DXY) dialled back some of its recent gains and followed 10-year Treasury yields lower, while the S&P 500 opened higher to set course for a fresh record high before the long Independence Day weekend.

While this latest US NFP report would still be ringing in market participants’ ears in the coming week, there are more job markers to be digested alongside other potential market-moving events:

Monday, July 5

- US markets closed

- Composite/services PMIs for China, Eurozone, UK

Tuesday, July 6

- RBA policy decision

- Eurozone retail sales

- Germany factory orders, ZEW survey expectations

Wednesday, July 7

- FOMC minutes

- US JOLTS report

- Germany industrial production

Thursday, July 8

- EIA crude oil inventory report

- Germany trade

- US initial jobless claims

Friday, July 9

- China CPI, PPI

- G20 meeting on global minimum tax

- BOE Governor Andrew Bailey, ECB President Christine Lagarde partake in panel discussion

- UK industrial production

USD index could post new 2021 high

Despite the dollar’s slight easing in the immediate aftermath of the June NFP release, the greenback could find new reasons to climb in the coming week. After all, the dollar finds itself in an environment where the path of least resistance appears northwards.

Note that the Jobs Openings and Labor Turnover Survey (JOLTS) report for May and the latest weekly initial jobless claims could show how robust the US jobs recovery has actually been, especially considering that the high-frequency jobless claims have fallen to their lowest levels since the pandemic broke out.

Those next markers of the US jobs markets will be interpreted along with the June FOMC minutes in ascertaining where to next for the US dollar.

Recall that last month’s Fed policy meeting produced a hawkish surprise, as Fed officials pencilled in two US interest rate hikes by 2023, in contrast to the lower-for-longer expectations that rates would be kept near-zero through the next couple of years.

Even though the US dollar has surged significantly since that 16 June announcement, the greenback holds more potential to climb even higher, especially if the minutes reveal even more hawkish chatter among policymakers or if the JOLTS report/weekly jobless claims point to a more robust US jobs market.

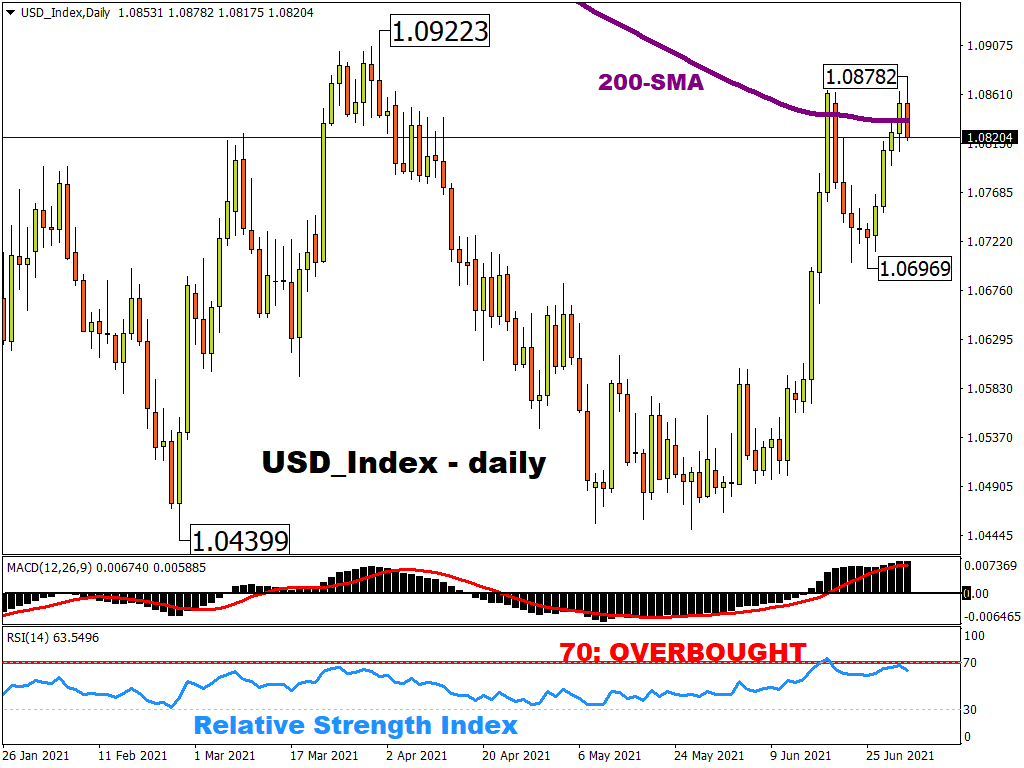

At least from a technical perspective, the equally-weighted USD index (which comprises 6 USD pairs) has already pulled back from overbought territory, with the 14-day relative strength index dipping back into sub-70 domain.

That should clear the path forward for more gains, with momentum indicators still pointing up.

At the time of writing, this tradable index is testing its 200-day simple moving average as an immediate support level. Despite the mixed US jobs data, this USD index appears to have enough reason to pursue a new year-to-date high above the 1.09 mark, based on the Fed’s hawkish pivot that we learned of on 16 June and to be potentially re-affirmed when the FOMC minutes are released in the Wednesday ahead.